When we hear the term currency most Americans immediately think of U.S. dollar, but currents from around the world come in many different shapes and sizes. The values of these currencies can very as much as their individual appearances. In today's marketplace with companies operating production facilities, supply operations, and sales thought the world precautions have to be taken in order to minimize risk, while tiring to maintain some form of ease in conducting daily business, regardless of the type of currency used to secure transactions.

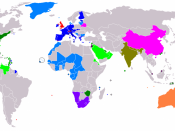

Before the days of unified currencies other items of value were traded for goods or services. In the fourteenth century the Aztecs for instance used the beans from the cocoa plant to trade for tools and clothing. In some African countries during the seventeenth century gold dust was traded for European goods. (Cyprus, 2003-2009) Across the world more then 100 different types of currency in circulation at any given time, it is this currency which is used as the main means of acquiring goods and services.

Currency has become a general term referring to minted or printed money or legal tender. Legal tender means currency is legally permitted to be used to obtain goods or services in a particular country. (Cyprus, 2003-2009) An example of this is if someone were to try to purchase new tires for his or her car at a local tire store the Ugandan shilling would not be considered a form of legal tender, even though Uganda shilling is currency. In today's business terms currency is broken into two categories, soft currencies or hard currencies.

A soft currency is currency oftentimes from a developing countries. The value of soft currencies tends to fluctuate often; larger countries with stable economies tend to now want to hold soft currencies in part because...