Introduction:The early 1990s brought about many dramatic changes to the economic business climate in the town of Sonora Mexico. These changes affected the profits and sucess for Guillermo Navallez and his furniture store, after many comfortable years with little competion for his hand made furniture. The emergence of a new competiter from overseas quickly increased furniture selection at rock bottom prices. The hightech approach from overseas produced high quality furniture through the use of expensive automated equipment. Guillermo must consider his financial options for the future to remain successful (Guillermo, 2009). This paper will discuss the different alternatives available to Guillermo Navallez, comparing the value of each through financial evaluation techniques that include use of multiple valuation techniques, risk reduction, and NPV.

Different alternatives available:Through evaluation of the Guillermo Furniture Store Scenario, there are three alternatives available to Guillermo Navallez, regarding the changes necessary for future success and survival of his furniture store business.

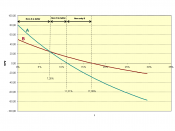

The first alternative is to stay in his current position and operate as he has for years, making little or no changes to the production process. The second alternative for Guillermo is to upgrade his manufacturing techniques and invest in the highly automated (high-tech) production processes that use advanced robotic technology and equipment for his furniture production work. The third and last alternative is to adopt the position of becoming a distributor (Broker) for a different competitor that currently operates only in Norway, taking advantage of the opportunity to provide channels of distribution in North America currently sought by this foreign manufacturer. These three options must be evaluated for the best alternative to provide better competitive advantage for Guillermo Navallez.

Many different methods are used to determine the value of undertaking and investing in projects that will require a capital budget investment. Many owners and managers...