21 INTRODUCTION �

32 Executive Summary �

43 Ratio Analysis & other Financial Ratios of the Company �

53.1 Revenues �

53.2 EBIT �

63.3 Depreciation and Amortization (NON-Cash Expenditures) �

63.4 Operating Profit after Tax �

63.5 Net cash flow provided from operating activities before debt cost and tax �

73.6 Shareholder's equity �

73.7 Returns on shareholder's equity �

73.8 Debt-service Coverage ratio �

73.9 Earnings per share �

84 Technical analysis �

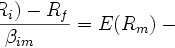

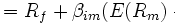

94.1 Cash Asset Pricing Model (CAPM) �

94.2 The formula �

104.3 Weighted Average Cost of Capital �

125 Conclusions and Recommendations:- �

136 Reference: �

�

INTRODUCTION

With the globalization of markets, greater foreign competition, and the reduction of entry barriers, it becomes all the more important to benchmark a company's financial indicators against other firms on a worldwide basis.

This report reflects to two inescapable trends: (1) a return to fundamentals, and (2) Corporate Feasibility in the concept of globalization. It's the Influential CEO of the company who have saved lots of World stock markets have recently witnessed a return to fundamental financial analysis. Sound management as contrasting to "propaganda" will in the long run generate shareholder value. This philosophy has lead to a greater emphasis on financial fundamentals and benchmarking.

The structure of the income statement is more telling. Does the firm have relatively higher costs of goods sold, operating costs, or income taxes? Are their returns on equity higher? Are profit margins greater? Are inventories held longer? What Technical terms say?

The goal of this report is to give the reader insight view of the company GWA International Limited. It is designed to assist consultants, financial managers, strategic planners, and corporate officers...