When a person is giving the use of his/her money to someone else, he or she is giving up spending the money today. Obviously the lender would expect something in return, a compensation for forgoing consumption until the borrower returns the money. This compensation is the real interest rate. Real interest rate increases when the demand for capital and borrowing is high in an economy, and falls when it is low.

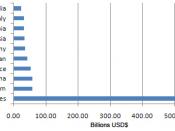

If the real interest rate differs from one country to another, then funds would flow from the country that has a lower real interest rate to a country that has a higher real interest rate. Arbitrage should occur between the domestic and international capital markets, in the form of capital flows between various countries. These capital flows among countries will then result in equalizing real interest rates across countries.

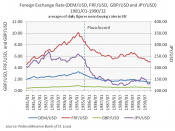

In international financial markets, changes in the interest rates lead to changes in foreign exchange rates.

The effect of changes in interest rates on the change in foreign exchange rate usually depends on the source of the interest rate change.

Changes in real interest rates can be either due to increase or decrease of money supply within the country, due to the actions of the RBA. The other reason for changes in real interest rates would be if there has been an imposition or removal of exchange rate controls.

Purchasing power parity

PPP is about the relationship between the prices of goods and services, in markets of various countries that use different currencies. The purchasing power parity (PPP) says that one unit of the home currency should have the same purchasing power around the world.

The PPP relationship says that the difference of inflation between two countries will be equal to the expected changes in exchange rates. The difference in...

High interest...for joy....

An interesting p.o.v.

Flows smoothly and expresses it's topic well...

Good Job.

1 out of 2 people found this comment useful.