IMF and its role in economic crises

Introduction:

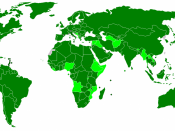

The International Monetary Fund (IMF) is an international organization that provides financial assistance and advice to member countries. It has become an institution integral to the creation of financial markets worldwide and to the growth of developing countries.

The IMF is responsible for the creation and maintenance of the international monetary system, the system by which international payments among countries take place. It thus strives to provide a systematic mechanism for foreign exchange transactions in order to foster investment and promote balanced global economic trade.

What is a crisis?

* Balance of payments difficulties in a country--that is, a situation where sufficient financing on affordable terms cannot be obtained to meet net international payments.

* The country's currency may be forced to depreciate to a level that seriously damages its domestic economy, and the problems may spread to other countries.

* Weak domestic financial systems, large and persistent fiscal deficits, high levels of external debt, exchange rates fixed at inappropriate levels, natural disasters, or armed conflicts.

IMF's measures:

Lending: IMF Lending aims to solve balance of payments problems and restore conditions for strong economic growth.

* Before a member country can receive a loan, the country's authorities must agree to the IMF's conditionality.

* In recent years, the largest number of loans has been made through the Poverty Reduction and Growth Facility (PRGF), which provides funds to low-income countries at below-market interest rates and over relatively long time horizons or by Stand By Agreements (SBA).

* The IMF provides other types of loans as well, including Emergency Assistance to countries that have experienced a natural disaster or are emerging from armed conflict.

Facts on IMF Lending

(as of December 31, 2003)

* Loanable funds - $ 85 billion, Of which, concessional loans...