�

Table of Contents

3Memo �

Executive summary 4

5CHAPTER 1 - INTRODUCTION �

5Background �

5Statement of Purpose �

6Scope �

6Limitations �

6Methods of Research �

7Chapter 2 - Finding �

7Issue at Hand �

8Impact on Regulation �

13Chapter 3 - Conclusion �

13Final Recommendations: �

14References �

�

Here is the report you assigned in partial fulfillment of the requirements for BUS 305.

Union Bank of Switzerland has been around since the mid 1800's; in its time it has acquired many other banks, through straight buy outs or by assimilation of other banks. Currently a multinational company having offices all over the world, it is a global leader in the banking industry.

This report analyzes the business ethics of insider trading and the consequences that Union Bank of Switzerland had encountered a few months ago. The company was involved with financial fraud, which included rogue trading in there London, based office.

The amount was nothing to shy away from with an amount of $2.3 Billion; it received extensive media attention because of its unethical business behavior. After the 2008 financial collapse, media was all over major banks for their unethical and greedy behavior and in 2011 the same type of unethical issues came to lime light again.

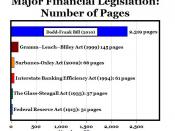

Currently in the United States, amendments have been put in place to counteract any unethical behavior that may be done in the banking industry. From the Federal Reserve Act of 1913, to the Dodd-Frank bill of 2010, it appears that the length of these documents have been getting greater and greater, because the amount of information that is needed to keep people from doing unethical business activities.

We allocated portions of the report to different group members. We met as a group a few times before this report was...