Big Drive Auto is a company that sells vehicles as well as services them. Fluctuations in the economy and interest rates can have affects on businesses and how they operate within the United States. This paper will discuss the following areas and ideas one, identify decisions made by key organizational stakeholders that are affected by interest rates. Two, identify how interest rates affect the cost of operating the business. Three, find the current yield curve and interpret the effect of its shape on decision-making within the organization. Four, evaluate how changes in interest rates affect the customer demand for the product in the scenario. Finally, this paper will explain how business planning and operations are dependent on monetary variables other than interest rates.

Interest rates can affect Big Drive Auto through vehicle sales, since a percentage of sales will require financing and is dependent on banking interest rates, which in turn can affect the types and dollar amounts of vehicles sold.

Stakeholders look at all aspects of sales especially the customer and how they are going to pay for the vehicles being purchased. Interest rates will impact how business owners make management and operational decisions. Big Drive Auto could make decisions about long-term investments in new buildings and equipment (Jednak, 2008).

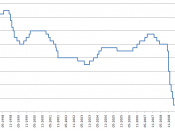

Interest rates can also affect business when purchasing and buying with net terms or on credit, the company who will be lending the money will most likely be charging interest for any unpaid balances. This is important because if one vendor is charging higher interest rates, the stakeholders will most likely buy from those vendors that are offering lower interest rates on the money. Interest rates affect the end users buying power if credit card interest rates go up, people could wait to get a repairs done their vehicles...