1.0 IntroductionInterest rates can be described as the amount of money charged as a fee for lending money or the price of borrowing money (Barney, 2006). If interest rates rise, you will have a larger mortgage and other debts; it is likely that you will have to reduce your spending. Savers will be encouraged to save more and spend less. A fall in interest rates will have the opposite effect.

Rates are now at their highest level since 1996 after 11 consecutive increases (Mes, 2008). With these high we can expect inflation to be high and unemployment low.

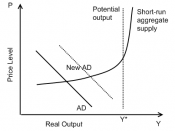

2.0 CausesThere are many reasons why there are interest rates rise, but they are mainly because of the increased spending and increased aggregate demand within the Australian economy. The monetary and fiscal policies are used to try and slow spending and to promote saving.

Inflation is defined as the change in the level of price (Barney, 2006).

High inflation within the economy causes interest rates to rise as high inflation reduces the purchasing power of money. One of the most common methods of measuring inflation is the Consumer Price Index or "CPI". The Consumer Price index is a measurement in the change in price of an average ÃÂshopping basketÃÂ of consumer goods for a country, within a month. This basket is then compared to the price change from the ÃÂbase yearÃÂ (A year that is selected where there are no dramatic increases or decreases in price), which gives it an index number to measure monthly increases or decreases in inflation (Barney, 2006).

Inflation has changed dramatically overtime and it is obvious why inflation and interest rates are so high now. Looking back, the average price for a kilo of potatoes were 75 cent now they are around the $4 mark, the same...