TGI

Brief Description of TGI

TGI (Target Group Index) is a fast-growing, global network of single-source market research company. They provide invaluable, comparable product, brand, media, attitudinal and demographic data for 57 countries across 6 continents. TGI was first started in Great Britain in 1969 to provide the advertising and media industries with a means of describing target groups for the broad spectrum of consumer goods and services. Importantly it also allows the identification of potential strategies for communicating with these audiences. Today, TGI is used more widely than ever to assist the understanding of target markets and to aid marketing and advertising decisions.

TGI is designed as a broad and rich measure of consumers. Each country's data is provided in database form and contains information on all aspects of the given universe: media consumption, product consumption, attitudes, behaviour and demographics. All studies follow standardised guidelines and formats but with the flexibility to fully reflect local market needs and characteristics.

TGI gives you information on readership of all newspapers and magazines, as well as reading of sections and topics of interest; viewing of terrestrial and satellite, cable, digital TV; national, regional and local radio listening exposure to, and recall of outdoor advertising; attitudinal information across the spheres of media, health, holidays, food, drink and finance; data covering thousands of brands across several hundred product categories. All in all, TGI offers clients a very flexible, and ultimately indispensable, marketing research tool.

The TGI Network is operated by KMR Group. Kantar Media Research Group (KMR Group) is an integrated international research, information and software group.

TGI recently expanded into East Africa; including Kenya, Uganda and Tanzania. It also has a major presence in South Africa, USA, Canada, and Europe at large.

TGI GEOGRAPHIC SPREAD

North America:

Source: TGI

Canada

United States

Latin America:

Source: TGI

Argentina

Brazil

Columbia

Ecuador

Mexico

Peru

Puerto Rico

Venezuela

Europe:

Source: TGI

Germany

Great Britain

Greece

Hungary

Italy

Northern Ireland

Norway

Poland

Rep of Ireland

Romania

Russia

Serbia

Slovak Republic

Slovenia

Spain

Sweden

Turkey

Ukraine

Australasia:

Source: TGI

Australia

New Zealand

Middle East and Africa:

Source: TGI

Iran

Israel

Kenya

Kuwait

Lebanon

Saudi Arabia

South Africa

Tanzania

Uganda

United Arab Emirates

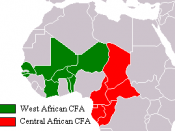

In a recent press release (September 2004) TGI International Director Paul Dickinson confirmed TGI expansion into East Africa (Kenya, Uganda and Kenya) is their most recent thread of global marketing. By visual analysis, TGI is virtually absent in North and West Africa region. A possible answer would be language barrier; west of Africa is dominated by French speaking nations, while North Africa is Muslim dominated with a closed society (Doole and Lowe 2004).

MACRO ANALYSIS

Mapping out Possible Markets of Entry

North Africa

o Egypt

o Morocco

o Algeria

o Niger

o Libya

o Sudan

o Tunisia

West Africa

o Cameroon

o Nigeria

o Mali

o Senegal

o Sierra Leone

o Togo

o Benin

o Chad

o Gabon

o Equatorial Guinea

TECHNIQUES OF MARKET ANALYSIS USED

A combination of techniques, described below, is used to determine a possible market of entry. At this stage, it is worth mentioning further vital indicators like the BERI index, and other important sources for statistics such as, US stats for foreign trade and commence, the Economist, UN department of statistics were beyond the researcher's means in order to analyse the market in question.

Business Procedures: The method and procedures of setting up a new business in the African continent varies from country to country. Countries that show a relative high ease of business procedures tend to be attractive to foreign businesses and vice-versa. The following table gives a snapshot of the duration business procedures in the various countries in the North and West African region under consideration. Morocco, Algeria, Niger, Sierra Leone and Cameroon stand out favourably.

Analogy Estimation: The East and South African region where TGI has got a presence share a similar psychometric attributes more with West Africa than with the Muslim-dominated North African region. The politics, economics as well as culture of East Africa are pretty the same with that of West Africa. Therefore, is logical to penetrate an area with a seeming familiarity with East Africa.

Economic Growth: Interesting to recognise that in 2003/2004, the economies of the West and North Africa are experiencing a higher growth rate than their counterparts in the South and East (ECA report 2004, p. 18) where TGI licensees are currently operating. Thus, the West African market is relatively more attractive for business.

But the question now is which country in the West of Africa should TGI enter?

Language: Six out of eight countries in the West Africa has as French the main official language; Nigeria speaks English; and Cameroon has as French and English as its two main official languages. Therefore, from a strategic perspective, Cameroon stands a better chance through which the markets in Nigeria and Senegal for instance could be penetrated at a later stage. Moreover, Cameroon is considered as having the largest economy in the central African region .

PROFILING THE CAMEROON MARKET FOR AUDIENCE RESEARCH

MARKET ANALYSIS

Synopsis about Cameroon

Cameroon is tucked alongside Nigeria on the Gulf of Guinea in West Africa. Cameroon is the dominant member of CEMAC, the six-country Economic and Monetary Community of Central African States. Its unique status as an officially bilingual (French-English) country offers British companies a more favourable climate through which to penetrate the francophone markets of the region.

With a stable macroeconomic framework and far-reaching structural and institutional reforms, Cameroon has been experiencing fast growth averaging 4 percent annually. Cameroon is keen to diversify beyond its traditional French suppliers and has actively courted UK plc. British companies active in Cameroon include Guinness (part of Diageo plc), Shell, Standard Chartered Bank and British American Tobacco. Cameroon trades mostly with Europe and the United States .

Cameroon is made up of about 16.5 million (2003 estimate), and Yaoundé-its capital city has an estimated population of 900,000. The economic capital and main port of Douala is estimated at 1.4 million. The country's literacy (aged 15 and over) stands at 79%; male: 84.7%; female: 73.4% (2003 estimate) . The following map situates Cameroon west of the African continent:

Accessibility

There are no limits on foreign currency visitors are allowed to import into or export from Cameroon, although foreigners can only export CFA 20,000 francs . Also, foreign exchange controls exist in Cameroon primarily for statistical purposes and to enable the Ministry of Finance to certify that remittances conform to established regulations . Authorizations for foreign transfers are routinely granted. Foreign exchange rationing is not practiced in Cameroon.

Currency

The currency in Cameroon is the Communauté Financière Africaine (CFA) franc. The CFA franc is tied to the French franc - CFA 100 francs = 1 French franc - and therefore also to the euro. It is issued by the Banque des Etats de l'Afrique Centrale (BEAC).

Consumption

TGI services would be of demand from the following segments of the country: Brewery, manufacturing industry, petroleum, media, Educational establishments, cinemas, NGOs, pressure groups, political parties, banks, mobile phone providers, international bodies and other individuals.

Let's take a look at some details the market size for audience research offers compiled from the CIA and cameroonzoom websites:

Mobile Phone Owners: 1.077 million (2003 estimate)

Internet Host: 479 (2004 estimate)

Internet Cafes: More than 100 in 2001

Internet Users: 60.000 in 2002

Radio Broadcast Stations: More than 30 (2005 estimate)

Cable and Satellite TV Providers: More than 3.

Newspapers: 26 national and regional either dailies or weekly

Cinema: 8 major cinema chains.

Communication Agencies: 32 agencies providing at least one communication packages such as TV, radio and outdoor advertising.

Multi-national Corporations: Guinness, Nescafe, Nestle, Dove, BAT, Standard Chartered Bank, City Bank, AXA, Total, Elf, Shell, Mobil, Texaco, Del Monte, Orange and MTN mobile network.

Other key organisations: IMF, World Bank, UNO and NGOs.

Competition

One is tempted to rush to perceive the market for audience research as latent. The indicators listed above supports the idea there is a potential market for TGI. The absence of literature on any independent data collecting firm in Cameroon would necessitate further field research. Even the 32 communication agencies currently in Cameroon, none is known to be conducting market research. However, senior lecturer of the Department of Journalism and Mass Communication, Buea University Dr Enoh Tanjong (2005) states a market research organisation is non-existent in Cameroon. This leads us to conclude that, it is a latent market, no direct competition.

Contractual Obligation

Setting up a new business in Cameroon is relative fast and straight forward. It takes twelve days and thirty-seven procedures in setting up a new business; fifty-eight procedures and five hundred and eight-five days to enforce a contract (UNECA 2005, p. 20).

Risk Evaluation

Economic: Though economic growth has not been significant (GDP 4.2%), it has been relatively constant as shown by the following diagram (OECD 2004, p. 3). The IMF projected the Country's GDP for 2005 to be 5.1%.

Cameroon has great potential and a bigger economy than its neighbours attracts foreign investors and not many local companies have the resources to tender for these state firms . This suggests a fairly good platform to enter the market with confidence.

Financial and Commercial: According to the Foreign and Commonwealth office (2004), several British firms are present in Cameroon, including Diageo (formerly Guinness), BAT, Standard Chartered and Shell enjoying the relative stable financial and commercial environment.

Political: Unlike some its neighbours, Cameroon has enjoyed a long standing stable political climate as opposed to Nigeria, Cote D'Ivoire, Sierra Leon, and Liberia). Taking this in consideration coupled with the above, it is safe to label the market in Cameroon as low risk for TGI to expand into Cameroon.

If we were to employ the four-risk matrix of Doole and Lowe (2004), shown below, Cameroon given its current state of political and socio-economic affairs would definitely be a low risk country for business.

Recommended Entry Method

There two most possible entry methods available to TGI include Licensing and Franchising.

LICENSING

TGI would grant the host company the right to use its trademarks and copyrighted materials. It would furnish as well, the host company its technological property and methodology coupled with training aides.

Why Licensing?

Traditionally, TGI expansion into East and South Africa has been by licensing. It is possible that they might consider pursuing the same policy.

Although there is a potential market for TGI, it does not exclude the risks that come along entering a new market.

It is suitable to approach an established agency with the necessary logistics in place. The ultimate benefit would be reduced cost.

FRANCHISING

TGI would grant the legal rights to the franchisee to use its branding, trademarks and products in return for a franchise fee. Unlike licensing, it would give TGI a greater control over the franchisee's method of operation. It would provide the necessary software and hardware, training, and methodology techniques to the franchisee.

It is advisable for TGI to pursue a multi-unit franchising in Cameroon; operating in the two major cities- Douala and Yaounde- the country's economic and capital cities respectively.

IMPLEMENTATION

Critical Success factors

At this stage, this report would like to recognise the absence of market research data on the needs of the segment of the market it would serve makes it impossible to determine the right level of investment for TGI to pursue. Therefore, TGI would have to think outside of its current marketing structure and rely heavily on its local database knowledge in already established markets in other parts of Africa.

TGI experience in South Africa, and recently Kenya, Uganda and Tanzania would be invaluable in the Cameroon context. That is, in terms of product usage, culture, gross national product and business procedures. The knowledge could potentially save the company from making expensive mistakes.

Volvo's experience in India is a good example of this (Hansted and Hemanth 1999, p. 3). The Swedish Volvo group is best known for its manufacturing of cars, trucks and buses, but it also produces marine, industrial and aircraft engines. When Volvo was about to enter the Indian market, it used experiences obtained in Brazil to create the strategy. Volvo chose to introduce itself as a transportation provider to India by building buses for mass transportation. It set up a manufacturing unit to make buses that suited the narrow lanes of India. Volvo now is working with state governments to introduce buses instead of subways. Not only has the benchmarking effort saved Volvo from making an expensive misplaced investment in car production, it has also generated a lot of goodwill for its humanitarian and environmental appeal.

Before initiating a strategic plan, TGI should determine what it expects to achieve in the new market and how much time is required. Also in this critical stage, the company must decide on pricing, positioning, targeting, branding and communication coupled with the following vital issues.

Resource Shipping: TGI's award winning technology and methodology including training aides be made available to match the company reputable standard in data collection.

Competency of host staff: TGI would ensure that the employees of the licensee/franchisee meet the high standard of skills capable of conducting audience research by providing adequate training where necessary.

Communicating TGI's core identity: Being a global company, its core competency needs to be communicated effectively and efficiently not only to the licensee/franchisee but also the specific markets its serve. Its corporate core identity should be communicated distinctively and clearly to the licensee. The elements of the communication mix (personal selling, advertising, sales promotion and public relations) would be invariable in creating awareness and positioning TGI services as efficient, effective and reliable.

Networking: Communication with the potential clients (including foreign clients interested in data pertaining to Cameroon) such as brewery industry, media organisations, NGOs, educational establishments, which systematically builds relationships. A phenomenon Doole and Lowe referred to as relationship marketing.

Marketing Communications strategy: The licensee might be constraint by limited resources to carry out promotion. In this case, TGI could carry out the promotion or make use of established intermediaries.

Language Concern: The fact that Cameroon is bilingual- French and English would necessitate translation and adaptation of the product in French language. Every English written business material should accompany an exact French equivalent. This is a country where 80% of the population are French speakers and most businesses are conducted in French as well as in English. That might look as cost duplication; but then the pay-off later is unimaginable.

Timing: The entry period into Cameroon is most suitable in the dry season that runs from September-April. It is popular considered the most favourable period for business.

Pricing: Pricing also can be a critical issue, as the customer base in emerging markets tends to be less affluent (Hansted and Hemanth 1999). Often the pricing issue requires logical thinking on the part of the host marketer as well as the home marketer. In this case, between TGI and its licensee/franchisee.

However, there are number of issues that fall short of making this report a comprehensive TGI business case for Cameroon. The absence of an independent market research data on the growth of audience research in Cameroon. Even the assertions of the HOD of Journalism and Mass Communication of Buea University cannot yield a valid picture in so far entry a new market is concern. Robust information would be required to support his claims. Moreover, vital indicators to assess the market for audience research in Cameroon were beyond the financial means of the student. The time to collect essential information for this report is an issue of consideration. By the time this work was being compiled, there was other essential information en route to the student. It is of interest of the student to review this report in a later stage.

REFERENCE

Book

Doole, S. and Lowe, R. 2004, International Marketing Strategy: Analysis, Development and Implementation, Thompson.

Journal

Hansted, K. and Hemanth, G. 1999, 'Integrated Marketing Communications: A Valuable Tool in Emerging Markets', Journal of Integrated Marketing Communications, [Online], 1999-2000, pp. 1-6. Available: http://www.medill.nwu.edu/imc [2005].

World Wide Web

OECD 2005, 'African Economic Outlook 2003/2004 - 22 Country Studies'. [Online] Available: http://www.oecd.org/dataoecd/45/11/32412420.pdf

Foreign and Commonwealth office 2004. [Online] Available: http://www.fco.gov.uk/servlet/Front?pagename=OpenMarket/Xcelerate/ShowPage&c=Page&cid=1007029394365&a=KCountryProfile&aid=1019501174254

IMF 2005, 'Cameroon'. [Online] Avaolable: http://www.imf.org/external/country/CMR/index.htm

UNECA 2005 Publication: Striving for Good Governance in Africa: Synopsis of the 2005 AGR, p. 20. [Online] Available: http://www.uneca.org/agr/

UNECA 2005, 'Economic Report on Africa 2004', p. 39. [Online] Available: http://www.uneca.org/ERA2004/