Problem/Objective

The objective of this research is to identify the attitudes of bank clients toward Islamic banking and to determine the factors that will encourage or limit the growth of Islamic banking in the coming five years.

Importance of Problem

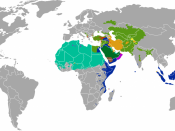

In the decade of the 1990s, a variety of changes took place in the Middle East. To start with, the technological revolution that swept the world during this period had a very significant impact on financial markets, both in world financial markets and in the region, and also allowing for many non-traditional forms of financial institutions and services to evolve. In addition to this, the period at the end of the 1990s, and especially following the events of September 11, witnessed the growing strength of Islamic influence on business and finance in the Middle East, particularly as many Arab and Muslim investors started to pull their funds out of American and other western banks and institutions to invest them at home.

More importantly, however, Islamic banks are on the rise today because the growing body of research that shows Islamic banking to be as competitive, attractive and profitable as conventional banking if not more. In the coming few years, millions of Muslims will be searching for Islamic banks and banking services to process and invest their money in line with the Islamic shari'a, especially that non-traditional banks are not capable to satisfy such a need as these conventional banks are based on the concept of interest which is prohibited by Islam.

Research, is therefore needed in order to identify the strengths and weaknesses of Islamic banks to meet the demand of Muslim depositors, investors and businesses according to the rules of Islamic Shari'a. It is also necessary to know the perceptions, expectations and attitudes of potential or existing clients...

Comment

The concepts of Islamic banking is clear to me now!

0 out of 0 people found this comment useful.