For a clearer picture of the U.S. economy here are some of the trends that affect us today. These indicators are the financial market, industrial sectors, inflation, unemployment, and consumer market. Some of the more modern indicators are the sales of cars, new housing starts, and sales of durable goods.

Prior to September 11, we learned that the recession began in March of 2001. In fact, the percentage of consumers rating today's economic condition as good is at its lowest level since April 1994. (Jacobe, 2002) Even though the United States economy is in a relatively shallow recession, industries are still working well because people are still buying things such as automobiles.

The U.S. economy has been growing slowly this year, the unemployment rate unexpectedly tapered off slightly in late summer, and there was another stock market rebound in October. But troubling signs, including four straight months of decline in the index of leading economic indicators, still overwhelm positive news.

The threat of war from terrorism unrest in the Middle East, and the unethical behavior of many corporate executives, has created reactions in the stock market making a hesitant economy.

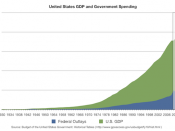

Federal Deficit

*The multi-trillion dollar federal budget surpluses protected for the decade following the Clinton administration has vanished and the prospect of red-ink federal budgets far into the future is very real The federal budget surplus of 2.3 percent of Gross Domestic Product (about $230 Billion) in the last year of Clinton's administration has, in two years of Bush, turned into a federal deficit of 2.3 percent of GDP (about $230 Billion). This is the largest two-year negative shift in the federal budget since World War II. (The America's Intelligence Wire, Jan 27, 2003)

Unemployment

Unemployment is expected to decline moderately throughout the forecast period to roughly 5.4% by this...

Concise

Clear, concise, and to the point. It's the kind of essay I prefer to read.

4 out of 5 people found this comment useful.