Like any other financial derivative, credit derivatives provide payoff to the investor that depends upon the underlying default risk associated with any financial instrument, especially bank loans.

Of late, the growth in credit derivatives market has been phenomenal, especially in the United States and in European countries.

Going by the British Bankers' Association Survey the global credit derivatives market comprised nearly $1 trillion as of year 2000. Probably the greatest motivation behind such a growth has been due to the gap between commercial banks and other financial institutions such as insurance companies, mutual funds and other non-banking financial institutions so far as conventional bank loan market is concerned.

Traditionally, the loan market -- which offers higher rate of return than many other assets available elsewhere in the market -- is not accessible to other financial institutions. Yet at the same time banks may be interested to trade default risk as a separate exposure and this requires the takers (read financial institutions) who can provide this kind of protection.

Credit derivatives, in this regards, are a noteworthy step which could not only bridge this gap but also develop a much more efficient market for bank loans.

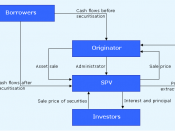

Typically, a credit derivative instrument involves stripping the credit or default risk embodied with a bank loan or a corporate bond or a portfolio of such assets, thereby creating a separate financial instrument altogether.

This not only provides protection to banks against 'bad assets' but also makes the credit risk amenable for trading as a separate derivative instrument. This is probably the most noteworthy feature of credit derivatives, i.e., instead of having derivatives written on the asset itself (as in case of equity derivatives), only the credit or default risk aspect of the loan (asset) is transformed into another hybrid and tradable instrument.

In banking...

Just what are credit derivatives?

Good essay. First time ever hearing about credit derivatives. Keep up the good work.

1 out of 1 people found this comment useful.