Running head: LAWRENCE SPORTS WORKING CAPITAL POLICYLawrence Sports Working Capital Policy PaperKatrina L. BaileyUniversity of PhoenixLawrence Sports Working Capital Policy PaperA manufacturer and distributor of equipment and protective gear for baseball, football, basketball and volleyball, Lawrence Sports is a mid-sized company with $20 million in revenues. Its principal customer is Mayo Stores, the world's largest retailer, which accounts for 95% of Lawrence's sales. Lawrence Sports has two principal suppliers, Gartner Products and Murray Leather Works. Although Gartner is responsible for providing 70% of Lawrence's raw material, Lawrence is not one of Gartner's major customers. However, accounting for 75% of sales for Murray Leather Works, Lawrence is considered a major customer whose working capital policies could negatively impact Murray's already weakened cash position (University of Phoenix, 2008).

One of the main reasons companies fail is their inability to meet working capital requirements. In order to maximize the firm's value over the long run, the company must first be able to meet its short-term obligations.

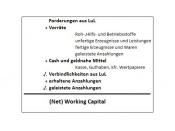

As a result, an effective, efficient working capital policy is essential to the long-term survival of any company. At Lawrence Sports, an ineffective working capital policy is wreaking havoc on the company's ability to meet its short-term liabilities. Cash balances are not adequate to meet working capital requirements and the company finds itself borrowing heavily from its credit line, and incurring higher and higher costs of credit. In order to fix their working capital woes, Lawrence Sports must address issues concerning their cash flow budgeting, cash balance requirements, and their current credit polices as they relate to both their customers and their suppliers. In addition, the company must implement a short-term financing plan that will help them minimize or eliminate their current cash flow gaps, and establish metrics that will allow them to measure the efficiency of...

![[Portrait of Juan Tizol(?) and Lawrence Brown(?), Aquarium, New York, N.Y., ca. Nov. 1946] (LOC)](https://s.writework.com/uploads/7/77189/portrait-juan-tizol-and-lawrence-brown-aquarium-new-york-n-thumb.jpg)