1) The scenario is that Bonnesanté's first drug needs to get to Food and Drug Administration trials in six months. For this, it needs to urgently acquire a mainframe computer for running advanced analytical software. The decision needs to be made to select the optimal mode of financing the acquisition by evaluating the lease and buy options available. According to the CEO, it is better to lease simply because of obsolescence. The computer equipment outdates itself very quickly and with smaller more affordable machines becoming much more capable over time, it is advisable to select a short-term lease. The COO says that the best thing to do is buy. He says that the main frame is a long-term investment and an asset that we can also claim depreciation on and thus get tax breaks from it. The Consultant says that leasing is the way to go because it will not show on the balance sheet.

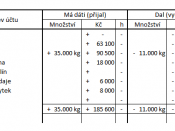

She also mentions that as a non-profit company, they are not subject to the taxes that the COO was talking about being sheltered from. The data indicates that the 18 month lease with no down payment would be the best to take because it has the lowest present value of outflows.

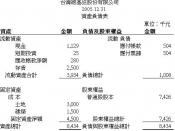

2) The scenario is that Bonnesanté must acquire an advanced digital spectrometer for R & D. It is priced at $2,000,000. Options exist for an operating lease, a capital lease, and to buy the equipment. To make a decision, first evaluation must be done of the duration for which the equipment is needed, the present value of the options, and the impact on the balance sheet. The options available are range from a short term operating lease, a capital lease, and a loan to buy the spectrometer outright. The CEO says that because of...