Essay topic1.

Introduction:

During the years after World War II, the development of the IS-LM model took several directions. Probably, the most prominent ideas on that theory were expressed in the work of John Hicks called "Mr. Keynes and the Classics". The model expressed in the article was largely based on the works of John Maynard Keynes and became a widely accepted as the alternative framework to standard Keynesian analysis. The IS-LM model is a way of modelling equilibrium in the economy by looking at equilibrium in the goods and services markets (the IS curve) and equilibrium in the money markets (LM curve). Where both these markets are in equilibrium will be the equilibrium level of income. The IS-LM model looks at income against the rate of interest. Hicks used this model to explore the assumptions concerned with investment, savings and the supply and demand for money. The IS-LM model can also be used for the analysis of crowding out of private sector investment caused by government intervention in the economy.

In my work I would like to show the detailed mechanism according to which increase in government spending leads to reduction in the private investment and consider the factors by which this economic phenomena is influenced. The main factors of which are elasticities of IS and LM curves and degree of multiplier effect by which IS curve is affected.

Main Body:

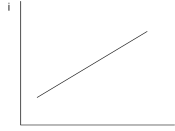

The strength of the model is that it combines events in the financial market with events in the market for goods and services to establish an equilibrium level of overall demand. Two variables - aggregate expenditure and the interest rate adjust to ensure that the demand for investment goods matches the supply of savings, and the demand for money matches the supply. On a graph, (see figure 1),

LS-LM

great, well written and give a good explaination on the ISLM economic model. Good use of example with work of John Hicks "Mr. Keynes and the Classical". Should be a good reference for economic students

1 out of 1 people found this comment useful.