Discussion.

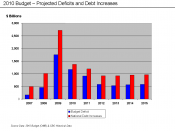

The article is about the Malaysian government had announced the RM17bil stimulus package as to assist the recovery of the economy (Yeow, 2009). Thus, the economic issue pointed up here is regarding the expansionary of Malaysian Government spending which is one of the instruments of fiscal policy. Moreover, Malaysia have been experiencing prolonged budget deficit since the 1997 Asian crisis, therefore, this stimulus package had further widen the Malaysian budget deficit from 4.8% to 6.1% of GDP (Yeow, 2009).

This can be analyzed through utilizing the theories and relationships between the market for loanable funds, net capital outflows and the market for foreign-currency exchange. Several identities used to show this relationship, which derived from gross domestic product (GDP), that is divided into consumption (C), investment (I), government spending (G), and net exports (NX), written as:It is a macroeconomic issue as it affects the whole economy of Malaysia. Furthermore, government sector, external sector, exchange market, financial market, private and foreign investors and domestic residents are also among those involved in this issue.

Firstly, government budget deficit means the government spending exceeded the receipts on tax revenue (InvestorWords.com., 1999). Given the GDP identity above, another identity is derived stating that national savings (Sn) equals to investments (I). As saving, Sn is the total income remains in the economy after paying for consumption and government purchases (Mankiw, 2007).

Hence,it reveals that Sn is composed of private savings (SP) from (Y- T- C) , and public savings (SG) from (T-G).

When budget deficits, SG will decrease, because government will borrow more to finance the deficits, so will then decreases the Sn : . This will lessen the supply of loanable funds available to be lent out. Therefore, there will be a shift of the supply curve for loanable funds to the left...