This analysis paper will describe the instruments of monetary control used by the Federal Reserve Bank to change the supply of money and in turn affect the macroeconomic factors: gross domestic product, inflation rate, interest rate and unemployment rate. The intention is to find the combinations of monetary policy that best achieve a balance between economic growth, low inflation, and a reasonable rate of unemployment. The paper will also investigate how macroeconomic factors change in given economic situations through the results obtained in the Monetary Policy Simulation.

Monetary Policy ConceptsMoney plays an import role in the economic life of people.

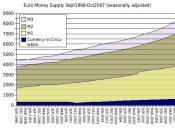

The money supply and changes in the money supply affect the decisions of every consumer and producer, as well as the activity of the government. Because of the important link between money and the levels of income, employment, and prices, all modern governments exercise some degree of control over their system of financial institutions.

In the United States, these controls began taking their modern form with the creation of the Federal Reserve System in 1913. (Willis & Hom, 2002, p. 363)The Federal Reserve Bank (Fed) acts as a central bank in the United States and is responsible for monetary policy. The Federal Reserve is an independent agency that does not take orders from the Congress or the president, so that the monetary policy is independent of the legislature and the White House.

Tools Used By Fed to Control Money SupplyThe main tools that the Fed uses to control money supply and see the effect it has on the economy are the spread between the discount rate (DR) and the federal funds rate (FFR), the required reserve ratio and the open market operations (OMO).

Spread between the discount rate and Federal funds rate. The two interest rates that Fed is...

Excellent

Greatly explains macroeconomic impact with details and statistics.

2 out of 2 people found this comment useful.