Managing Financial Resources and Performance

Assessor:

SUBMITEED BY:

STUDENT ID:

TABLE OF CONTENT

Page No

Introductionâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦ 03

Requirement 1:

1.1 Identify the need for financial resources within Asda's strategic planâ¦â¦â¦â¦â¦ 04

1.2 Assess the Appraise Methodsâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦ 04

1.3 Evaluate the Impact of Financial Resource Decision Makingâ¦â¦â¦â¦â¦â¦â¦â¦â¦ 05

Requirement 2:

2.1 Net Present Valueâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦ 05

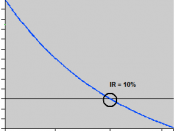

2.2 Internal Rate of Returnâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦ 05

2.3 Difference between Risk and Uncertainty ................................................................ 05-06

2.3.1 How sensitivity analysis and probability analysis can be used to

Incorporate risk into investment appraisal process........................................ 07

Requirement 3:

3.1 Selection of data to use in analysing business performance........................................... 08

3.2 Evaluate performance data to support strategic decision makingâ¦â¦â¦â¦â¦â¦â¦.. 08-09

3.3 Analyses business information to make substantiated recommendations

About improving business performanceâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦.â¦â¦..â¦10-11

Requirement 4:

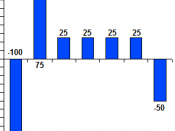

4.1 Net Present Value of a new project to manufacture and sell a brand new gadgetâ¦â¦â¦â¦.11

4.2 Viability of the Projectâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦.........11-13

4.3 Calculate unit costs of making a gadget.........................................................................â¦...11

4.4 Cash Budgetâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦11

Conclusionâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦13

Referencesâ¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦â¦..â¦.14-15

Introduction

This assignment is to understand the impact of the financial resources of an organization and evaluate different performance measurement methods with in an organization. The different appraisal method such as Net Present Value and Internal Rate of Return.Net Present value is the most popular appraisal method which gives true answer than the other methods. If in a Net Present Value Calculation value becomes as a positive that means the project should be acceptable. If the Net Present Value becomes as negative that means the project should be rejected (Richard, 2011).

Internal Rate of Return is another important appraisal method which calculates by taking two discounting rates. This is also developed under very logical manner where highest internal rate of return would be acceptable. But in a case of mutually exclusive project, Internal Rate of Return concept would not be...