An acquisition is one of the fastest ways for globe business to enhance their reach across the world.

Buying a local business can have its advantages, because setting up ones own operations in a new country may take time. It might also prove to be more expensive.

However, international acquisitions are more complex than domestic acquisitions because the legal and business environments are different.

Assuming that foreign acquisitions of business is permitted, fundamental issues such as identifying the evaluation criteria and evaluating the gain from an acquisition come into the spotlight.

This simulation highlights the need to evaluate the right evaluation criteria and accurately analyze the various factors that might influence the evaluation of the gain from an acquisition.

In this simulation, one of the world's largest banks called First South Pacific bank (FSPB) with over $400 billion in assets has an extensive network of operations in Americas and Europe.

This bank intends to enter the Republic of Kitanesia.

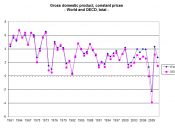

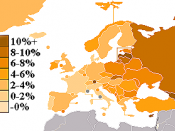

Kitanesia has an economy that is growing at a fast rate. FSPB senior management has decided to acquire one of the local banks of Kitanesia.

FSPB's strategy is to target the consumer finance and corporate finance segments.

Six local banks have been identified as potential targets for acquisition. But we need to identify which banks are the best strategic fits for FSPB and narrow the banks down to three. For this we need to analyze each bank on the following parameters:

1. Competitive position of the bank in the market segment

2. Assets and liabilities of each bank

3. Sectoral exposure

4. Network of branches/ATMs

5. Product Range

Now we will evaluate the six banks based on the above different evaluation criteria, and rate each bank's strengths on the criteria and identify the top three that have the highest rating. The...