So far 2006 is looking good but can we head into a recession? In looking at history, we should keep in mind that stocks tend to discount the future and we shouldn't make any absolute judgments on which way prices will go based on the past. And as such, we shouldnÃÂt jump to the conclusion that it will be up, up and away once the fed says it's done. A more important consideration would be the status of the business climate and the economy when the fed rings the "all done" bell. So, as usual, there is no easy way out and well having to keep our eye on the ball.

LetÃÂs see if I can try to answer this. There is a saying donÃÂt fight the fed ever. Nevertheless, the bond market seems intent on doing just that. In one corner, key bond players believe the economy is slowing and inflation is not a threat, and the fed is almost done raising rates.

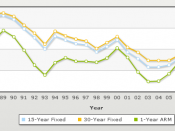

in the other corner, fed policymakers appear to favor a more aggressive approach to lifting rates in order to contain inflation and find it puzzling that the bond market and long term rates are resisting the fed's lead. By historical standards the 10 yr yield should be in the 5-6% range. Market rates that low are at cross purposes with the fed's goals. Policymakers are lifting short rates from levels that are still too simulative to growth and inflation. However, credit remains for now freely available in the financial markets. Mortgage rates are only now approaching 6%; strangely, none of this seems to worry the bond market. In particular, bond folk point to the flattening of the yield curve is a traditional sign that the economy is slowing down. But keep in mind currently 10 yr...