In this essay I am going to discuss models of oligopoly behaviour and analyse them and see whether they are realistic or not and evaluate them with certain examples where they may be most suitable.

An oligopoly is a market which consists of few firms which sell similar or homogenous products. In this essay I will also be looking at a duopoly, which is a market with two firms.

The Cournot equilibrium, this is where "a pair of output levels, one for each firm, which are such that after they are chosen neither firm, has an incentive to change its output level"1.

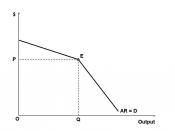

To easily understand the Cournot equilibrium, let us consider a duopoly (a market consisting of two firms). In most markets, the market price is where supply is equal to demand. Therefore, the price firm 1 sets itself is dependant on the quantity supplied of firm 2.

When firm 1 chooses the supply quantity, it assumes that the current quantity firm 2 supplies are fixed. Costs can be thought of a function of its own quantity supplied, because costs of firm 1 are independent of whatever firm 2 supplies.

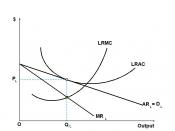

In this market specifically, firm 1's reactions depend on the action of firm 2. A reaction function is used to show the optimum level of if the other firm changes their supply level. Assuming that each firm profit maximises, therefore the profit functions are:

à 1 = (A-b(q1+q2)) * q1 - C(q1) à 2 = (A-b(q1+q2)) * q2 - C(q2)

Firm 2 decides to supply 200 units on the market; therefore firm 1's profit is dependant on its own supply to the market:

à 1 = (A-b(q1+200)) * q1 - C(q1)

It will then produce where marginal cost is equal to marginal revenue to profit maximise.

Suppose firm 2 increases the...