After 1990 the New Economy was born and the peace dividend was enormous. Facing no significant external dangers, military or economic, it became safe to shift resources to the private sector. From 1990 to 2000, defense spending fell from 5.2% of gross domestic product to less than 3%, the lowest level in the postwar period. And overall, the public sector's role in the economy dwindled. Total government spending on workers and purchases of goods and services also plunged from 20.4% of GDP in 1990 to 17.6% in 2000, a level not seen since 1948. Over the same stretch, the private sector thrived. Output soared and the economy expanded in every dimension--globally, financially, and technologically. Foreign trade more than doubled. Venture capital, debt financing, and stock-market values all grew faster than GDP. However, there is a danger that the shift to the public sector could go too far.

Daniel E.

Laufenberg, chief economist at American Express Financial Advisors, is predicting that the economy will generate 3% growth in 2002. But that won't necessarily produce a return to the free-market attitudes of the 1990s. Even if growth is positive, the unemployment rate could still keep rising if companies hold down hiring to boost productivity and profits. That's what happened in the early 1990s, when the unemployment rate peaked in June, 1992, more than a full year after the 1990-91 recession ended.

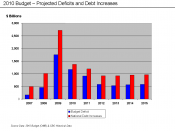

The United States has a strong economic position in the international market and the U.S dollar is one of the most powerful currencies. However a few issues require continuous monitoring. One of the foremost issues in understanding U.S economy is the budget deficit position. Budget Deficit is spending financed not by current tax receipts, but by borrowing or drawing upon past tax reserves. Since 1980 the deficit has grown...