RATIO ANALYSIS

It refers to the systematic use of ratios to interpret the financial statements in terms of the operating performance and financial position of a firm. It involves comparison for a meaningful interpretation of the financial statements.

In view of the needs of various uses of ratios the ratios, which can be calculated from the accounting data are classified into the following broad categories

Liquidity Ratio

Turnover Ratio

Solvency or Leverage ratios

Profitability ratios

A. LIQUIDITY RATIO

It measures the ability of the firm to meet its short-term obligations, that is capacity of the firm to pay its current liabilities as and when they fall due. Thus these ratios reflect the short-term financial solvency of a firm. A firm should ensure that it does not suffer from lack of liquidity. The failure to meet obligations on due time may result in bad credit image, loss of creditors confidence, and even in legal proceedings against the firm on the other hand very high degree of liquidity is also not desirable since it would imply that funds are idle and earn nothing.

So therefore it is necessary to strike a proper balance between liquidity and lack of liquidity.

The various ratios that explains about the liquidity of the firm are

Current Ratio

Acid Test Ratio / quick ratio

Absolute liquid ration / cash ratio

1. CURRENT RATIO

The current ratio measures the short-term solvency of the firm. It establishes the relationship between current assets and current liabilities. It is calculated by dividing current assets by current liabilities.

Current Ratio = Current Asset

Current Liabilities

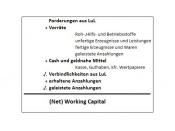

Current assets include cash and bank balances, marketable securities, inventory, and debtors, excluding provisions for bad debts and doubtful debtors, bills receivables and prepaid expenses. Current liabilities includes sundry creditors, bills payable, short- term loans, income-tax liability,