As a manager of a financial planning business you have two financial planners, Phil and Francis.

Financial Planning BusinessPeople make choices and judgments every day and they have to sacrifice one thing sometimes when they need more of something else. This means, in the economical world, trade-offs. When people are faced with multiple trade-offs they use the opportunity cost principle. Opportunity cost principle is a conclusion or decision that is established by relating it to what must be given up or the next best alternative as a result of the conclusion or decision. Any decision or judgment that engrosses a choice between two or more alternatives has an opportunity cost (O'Sullivan & Sheffrin, 2006). Businesses have to make these types of decisions every day.

Phil and Francis are two main financial planners at a financial planning business. Phil and Francis are both very hard working employees. As their manager, my delegation will be to use the statistics I have been provided and reach a decision that will conclude whether or not it will be more beneficial for these planners to be self sufficient or specialize.

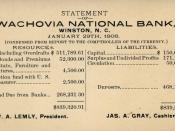

The statistics show that Phil, in one hour, can produce either 1 financial statement or answer 8 phone calls. In contrast, Francis can either produce 2 financial statements or answer 10 phone calls. When I figure these statistics into a work day that consists of 8 hours, Phil produces 64 phone calls or 8 financial statements, and conversely Francis produces 80 phone calls and 16 financial statements. These statistics clearly show that Francis has the absolute advantage when it comes to productivity and time by producing twice as many financial statements and answering twenty percent more phone calls than Phil in one hour.

To better explain my decision I broke Phil's and Francis's opportunity cost...

It is a very informative essay

Opportunity Cost, As a manager of a financial planning business you have two financial planners, Phil and Francis

0 out of 0 people found this comment useful.