Table of Contents

1 Introduction 2

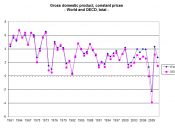

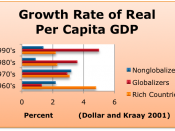

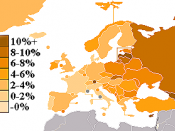

2 Determining the Medium and Long Term Growth Rates 4

2.1 Growth in the Telephone Directory Industry 5

2.1.1 Competition 6

2.1.2 Demand for Telephone Lines 9

2.1.3 A Short Summary of the Growth Prospects in the Region 10

2.2 Estimation of the Growth Rates for Argentina 11

2.3 Estimation of the Growth Rates for Brazil 12

2.4 Estimation of the Growth Rates for Chile 13

3 Calculating the Cost of Capital 13

3.1 The Godfrey and Espinosa (1996) Model 14

3.1.1 Determining the Risk Free Rate 15

3.1.2 Determining òadj 15

3.1.3 Determining the Market Risk Premium 17

3.1.4 Determining the Credit Spread 17

3.1.5 Calculating the Cost of Capital 18

3.1.6 Criticisms of the Godfrey and Espinosa (1996) Model 19

4 Determining the Cost of Debt 20

5 Calculating WACC 20

6 Calculating the Present Value of Paginas Amarelas 21

6.1 Valuing the Argentinean Operations 21

6.2 Valuing the Brazilian Operations 22

6.3 Valuing the Chilean Operations 22

6.4 The Present Value of the Operations of Paginas Amarelas 23

7 Conclusion 25

8 Appendix A 27

9 Appendix B 28

10 References: 29

1 Introduction

The aim of this case study is to determine the value of Paginas Amarlas, and advise Brasil Investimentos what the appropriate action would be, given the information available to them in 1996. Expected future events and forecasting techniques, together with the company performance results are used to perform appropriate valuations. The options available to Brasil Investimentos would be the sale or restructuring of Paginas Amarelas.

In order to value Paginas Amarelas, future cash flows would need to be projected, a long run perpetual growth rate would need to be determined and the weighted average cost of capital (WACC) would need to be calculated using the...