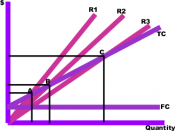

For any business it is important that the owner or manager understand the way in which the costs are made up and how a profit can be made. In order to assess the break even point and potential profits the different types of costs need to be assessed.

There are two types of costs, those that are the same no matter what level of business or production is undertaken, such as rent, these have to be paid even if there is no production. The second type of cost is the variable cost; this is the costs that will variable dependant in the production, the direct inputs into the production. For the barbers this is the shampoo, the shampoo is only used when there is active revenue production. (Horngren, Sundem, Stratton, 2005)The first stage is to assess the contribution level per haircut. This means taking the revenue that is gained and then deducting the direct (variable) costs.

This is shown in figure 1 below.

Figure 1. Contribution Margin.

Revenue per hair cut (a)12.00Cost of shampoo (b)0.40Contribution (a-b) (c)11.60As a % ((c/a) x 100))96.67%This means that it costs $.40 per haircut and as such the remaining $11.60 can be used to pay off the fixed costs, after the fixed costs are covered this will provide the profit. The contribution is $11.60.

With this we can now look at the Break Even Point. We are given two fixed costs, staff salary and the rent. These need to be calculated as annual costs.

Figure 2. Staff Wages as an Annual Fixed Cost.

Wage per hour (a)9.90Hours per week per barber (b)40Wages per week (a x b) (c)396.00Weeks per year (d)50Wage per barber per year (c x d) (e)19,800.00Number of barbers (f)5Wages per year (e x f)99,000.00Figure 3. Annual Rent.

Monthly (a)1750Annually (a...