"Capital budgeting ~ the process of analysing potential fixed asset investments. Capital budget decisions ~ probably the most important ones financial managers must take." (1)

"Financial and budgetary accounting are branches of the same discipline, but they have fundamentally different purposes. Financial accounting looks backward in time: it summarizes economic performance for a past period. Budgetary accounting, by contrast, looks forward: it measures the cost of planned acquisitions and the use of economic resources in the future." (2)

This seems to me to be a contradiction in terms, or could this be my untrained eye causing confusion?

However confusing, I think it's interesting, what appear to be two conflicting, deceptive, views seem to point towards an important benchmark. Why? Because we are also aware that this terminology is a break point and often used in the differentiation of managerial accounting and financial accounting, financial being future, so as I've really confused myself now, I'll try to rabble through my thoughts

It seems to me; (living in a houseful of women) that budgeting is really for the future, The anticipation of 'what might be' is based on the best available information, and so without a crystal ball both of the statements above have to be true.

Financial capital budgeting seems to me to be likened to driving forward whilst looking through the rear view mirror. This can be exampled by the estimation of future risk and so the 'go, no go' scenarios.

Information like that produced by the Ibbotson Associates (2 p313), which is based on the longest period possible, or available, the example given within our texts (2) the prior 74-year period is analysed to arrive at the current or probable future market risk, this is an assumption a cyclic economic, market variance, best and worst case scenarios.

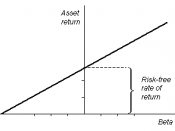

This may be a starting point, but I feel that this is purely quantative analysis, which is exampled again within our texts (2) page 312 where after listening to a lecture on the Capital Asset Pricing Model (CAPM) thought "Beware of academicians bearing gifts".

It appears that this data is based on the longest period possible to arrive at an anticipated market risk premium. This seems like a good idea, but then there is the absorption of the qualitative within this, and however confused I may appear, this I believe is what the businessman refers to. E.g. organisations generally employ differing types of capitol which will have differing risk, and differing maturities and so differing required rates of return or component costs, thus we have the weighted average cost of capitol relevant to the organisation, its environment and so it's 'real' decisions based on many past, current and future activities and performance relative to it.

So, in the NHS how can an organisation that bases its financial decisions on historical budgets be effective in a global health economy with rapidly shifting market conditions containing quick highly competitive and nimble competitors? (e.g. the purchase of surgical teams to reduce the waiting lists) It can't and so yes is the simple answer, I do believe my organisation should go to the time and expense of implementing a capitol budgeting system into the planning process. It seems to my untrained eye that the benefits outweigh the costs, but that is assuming that the pitfalls are known and understood. By this I mean the varying accounting methods employed, their use, fit and the application, are understood by the senior management team; for example we are given within our texts six example techniques with which to consider:

*IRR

*NPV

*MIRR

*PI

*Payback

*Discount Payback

Remembering that my organisation is publicly owned, and my individual Trust has a budget of ã108m and therefore has no bearing on any of the water marks given within our texts for large organisations thus suggesting it is not likely to value IRR or NPV as would a large organisation (2 p360) i.e. "small firms (less than $1 billion in sales)", is probably quite true (seeing as my DOF doesn't understand IRR or NPV!)

However, before we go any further I think it important to look at one very important, possibly the most and commonly overlooked key element of capitol budgeting the 'post-audit'.

The nature of our capital budgeting is stereotypical of the NHS and this 'old world' approach to capital budgeting is compounded (as I have previously stated) 'post audit'. I know as an organisation we are 'audited to death' there are 15 'arms-length' organisations who audit various parts of the NHS ~ the controls assurance framework (3) is the basis of many of the auditors investigations, but the post audit process's, and purposes (2p362-3) do not seem to figure in the NHS equation

The Trust is currently selling off some of its land to prevent an overspend position at the end of the year; the pre-occupation of achieving a 'breakeven' position sometimes clouds the main focus of our business (health). The capital budget we have provides a mechanism to smooth out peaks and valleys, regularise activity in an effort to maximise value and avoid loss, however as in 'industry' projects must be paid for, (all be it health focussed) and so I think that the CAPM is an important tool to measure risk and rates of return.

For example, "balance spending with the resources available within political, economic, and legal tax and debt limits." [4]

Or in simple terms keep the government happy!

References

1.www.cbo.gov/showdoc.cfm?index=440

2.Financial Management, Theory and Practice, Eugene F. Brigham, Michael C. Ehrhardt, 11th Edition

3.www.info.doh.gov.uk/doh/rm5.nsf/0/824f30c511a06e8900256b1b005f9216?OpenDocument

4.Mikesell, John. 1999. Fiscal Administration, 5th ed. Fort Worth: Harcourt Brace.