1.INTRODUCTION

The leveraged buyout phenomenon has been subject of many studies by a number of financial theorists, which have attempted to give an explanation of this trend during the 1980s, evaluating historic and financial aspects of that époque and previous.

In this essay, we will see at those different panoramas and aspects that took companies to accomplish a wave of corporate restructuring during the 1980s and why these factors enhanced the use of Leveraged Buyouts. In addition will se the diverse features companies must have in order to be a leveraged buyout target and the consequences after the buyout is accomplish in order to reach a better level of efficiency with and obvious benefit in capital gain for its investors.

2.THE BOOM IN LEVERAGED BUYOUTS (LBOs) DURING 80s

2.1WHAT IS A LBO

The leveraged buyout is a form of corporate restructuring which had its most important period during the 1980s.

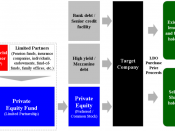

The essential characteristic of LBOs is the high level of debt is incurred in order to unify and reduce the ownership to achieve a superior point of efficiency and profits maximization. This dramatic increase in debt ratios, according to Hite & Owers (1996), can go from 1 to 10.

A LBO according to Brealey & Myers (2003) varies in two main ways from the normal acquisition process. First, the purchase of the stock is debt financed or at least a substantial portion, some often the debt used in this type of restructuring is debt below investment grade or also denominate Junk Bonds. Second, the LBO goes private and its shares do not trade longer on the open market.

This reduction and unification in ownership, brings itself a number of repercussions in the managerial level and the company's structure.

2.2HISTORICAL, ECONOMIC AND FINANCIAL FACTORS

According to Weston & Johnson...