Founded in 1934, Reed's Clothier and its owner Jim Reed II, is faced with loosing financing. The company has ample inventory, however, is strapped for cash as a 30 day deadline to pay a bank note for $130,000 approaches with only $85,000 in reserves. In order to meet his pending and future financial obligations, Mr. Reed must convert a portion of his $491,000 inventory into cash.

1. Calculate a few ratios and compare Reed's results with industry averages.

What do these ratios indicate?Reed's ClothiersIndustryLiquidity RatiosCurrent Ratios 2.022.7Quick Ratios0.941.6Receivable Turnover4.97.7Average Collection Turnover74.147.4Efficiency RatiosTotal Asset Turnover1.31.9Inventory Turnover2.97.0Payable Turnover7.015.1Profitability RatiosGross Profit Margin3033.0Net Profit Margin57.8Return on Common Equity1625.9Ratios are highly important profit tools in financial analysis that help financial analysts implement plans that improve profitability, liquidity, financial structure, reordering, leverage, and interest coverage. Although ratios report mostly on past performances, they can be predictive too, and provide lead indications of potential problem areas.

Ratio analysis is primarily used to compare a company's financial figures over a period of time, a method sometimes called trend analysis.

Through trend analysis, you can identify trends, good and bad, and adjust your business practices accordingly. You can also see how your ratios stack up against other businesses, both in and out of your industry.

There are several considerations you must be aware of when comparing ratios from one financial period to another or when comparing the financial ratios of two or more companies.

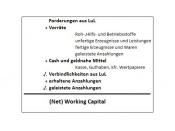

In comparing the financial ratios of Reed's Clothiers to the averages of others in the same industry, it readily becomes clear that Jim's preference of keeping a large inventory of clothing on hand was definitely having a negative impact on his business.

Reed's Clothiers inventory turnover ratio of 2.9 is extremely low in comparison to the industry average of 7.0. Also Reed's Clothiers quick ratio...