1. IntroductionEugene F. Fama and Kenneth R. French published an influential paper "The Cross-Section of Expected Stock Returns" in 1992, challenging the Capital Asset Pricing Plan developed in 1960.

Through their research and analysis, they found that the average returns across different stocks and portfolios do not depend on the beta ò when its changes are unrelated to size. There are two other factors, company size and its book-to-market equity ratio which play an important role in explaining the variation of stock return.

2. Empirical TestingThe stock return data collected and calculated were for the period of July 1963 to December 1990 while accounting data used were the fiscal year-end figures in calendar year 1962 - 1989. The half year gap between the two timeframes is in place as previous year results were generally released towards mid year.

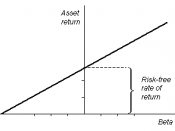

ò and SizeCAPM states thatE[ri] = rf + ò ( E[rm] - rf )ò represents the volatility of a stock or portfolio in relation to the entire market.

When the stocks were put in to portfolios according to size and then ò, there is clear evidence that ò explains the variation of average return. The higher the volatility, the greater average return was generated by the portfolio.

The two factors were then tested separately. Size grouped portfolios still demonstrates a negative relationship between sizes and average return. But there is no obvious relation between ò and average return.

Fama-MacBeth (FM) Regression confirmed the finding as the standard error for ò slope is close to 0, it has no reliable relationship. The explanatory power of ò is smaller than size even when both were used together.

Book-to-Market Equity Ratio, E /P, LeverageTheoretically, low book-to-market equity ratio stands for good earning prospectus, thus smaller return and vice versa.

It was supported by the tests...