Taxation � PAGE \* MERGEFORMAT �4�

Taxation

ECO205

Axia College of University of Phoenix

June 18, 2008

Jeff Weigel

Alcohol is taxed on a state and federal level; the taxes are handled on the federal level by the Tax and Trade Bureau (TTB). TTB was created within the Department of the Treasury in 2003 as a result of the Homeland Security Act of 2002. As a successor of the Bureau of Alcohol , Tobacco and Firearms, our mandate is to collect taxes owed, and to ensure that alcohol beverages are produced, labeled, advertised, and marketed in accordance with Federal law.

TTB administers Federal tax laws on alcohol , tobacco, firearms, and ammunition. Specifically, TTB is charged with the administration of Chapters 51 and 52, and sections 4181 and 4182 of the Internal Revenue Code of 1986 (IRC), as well as the Federal Alcohol Administration (FAA) Act and the Webb-Kenyon Act.

Under these authorities, TTB is chiefly responsible for: (1) collecting alcohol , tobacco, firearms, and ammunition excise taxes , and classifying alcohol and tobacco products for excise tax purposes; (2) reviewing applications and issuing permits for distilled spirits and wine operations and for tobacco product manufacturing, warehousing, importing and exporting operations; (3) regulating the production, packaging, and storage of alcohol and tobacco products; and (4) ensuring that the labeling and advertising of alcohol beverages are not misleading and provide adequate information to the consumer (Manfreda, 2008).

The Alcohol tax like most other taxes is levied on the consumers. There may be taxes levied on the producer, but they will pass that cost on to the consumer. Say the government decided to tax alcohol companies for a process that is harmful to the environment. The government would expect the company to pay the tax, which it would. But they would implement the charges in the cost of the alcohol, which in turn would leave the consumers paying the tax.

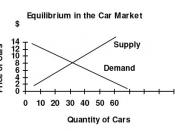

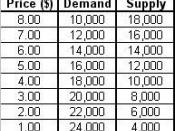

The alcohol tax affects both supply and demand, the demand would go up if there were no alcohol taxes. If alcohol were cheaper due to tax relief, people would buy more of it, if the tax were to increase the demand would go down. The supply follows the demand, so if the demand went up, so would the supply. Accordingly, if the demand were to go down, so would the supply.

At any price above X supply exceeds demand, while at a price below X the quantity demanded exceeds that supplied. In other words, prices where demand and supply are out of balance are termed points of disequilibrium, creating shortages and oversupply. Changes in the conditions of demand or supply will shift the demand or supply curves. This will cause changes in the equilibrium price and quantity in the market. Adding a tax to the cost of a good could throw the supply and demand curve off.

Suppose there was a gas shortage, and the only way to have this bounce back was to let the gas companies raise the price until the saw a noticeable change. But they could only raise it up to twenty dollars a gallon. Now let's say the gas companies got to the twenty dollar mark and were not seeing a profit that would rebound the crisis. That would mean that the price ceiling would lead to a shortage because the gas companies would not want to supply gas if they are not making a profit.

References

Alcohol and Tobacco Tax and Trade Bureau. Retrieved June 16, 2008 from

http://www.ttb.gov/about/index.shtml