� � PAGE \* MERGEFORMAT �1� �� RETIRING SMART WITH SOCIAL SECURITY� � PAGE \* MERGEFORMAT �2� ��

Retiring Smart with Social Security

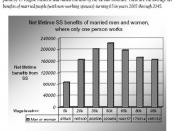

Social Security is designed to be a safety net to keep older Americans out of poverty, but it may not be enough to provide a comfortable retirement. There is much statistical data relating to Social Security along with many opinions as to how much income the average American will need to cover expenses and make his or her retirement comfortable. For a majority of Americans, Social Security benefits will not be enough. The average Social Security check can be expected to cover approximately 40 percent of one's pre-retirement income (Pond, 2010). If living within this smaller budget is not an option, one might consider other options like having a personal savings plan, putting off retirement for a few more years, or even to continue working past retirement age.

Just about every day, we are seeing or hearing something in the news about Social Security and its future. A large amount of controversy surrounds Social Security and whether or not it will survive these economic times or, if it does, for how much longer. If a person plans to live below the poverty line once he or she retires, and is happy to do so, relying solely on Social Security will be more than enough for him or her. However, a great number of us will probably not want to live that way. For the majority of us, the whole point of retiring is to live comfortably and not having to worry as much about finances. Once a person get to that stage in his or her life where he or she is planning to retire, there is much to consider and making sure there is enough money...