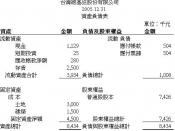

Industry AnalysisRiordan Manufacturing has a reputation for producing different forms of packaging containers. The industry which Riordan is identified with is a very competitive one. In comparing the wholesale production of different companies the median of the 41 companies surveyed produces results which will help Riordan continue to be a major competitor in the company's chosen field. Three points were reviewed when doing this industry analysis, current ratio, return on assets, and collection period.

The results of the analysis have been placed on a bar chart to show where Riordan falls on the median scale.

Current RatioThe current ratio shows that Riordan during the years of 2003 and 2004 fell below the industry average by .06 and .07 respectively. This shows a decrease in the ratio of assets to liabilities. A decrease in assets and an increase in liabilities would require further investigation as to the issue creating the problem so proper steps can be taken to turn this trend around.

Return on AssetsThe return on assets analysis showed a difference of .88 and 3.34 variance when compared to the industry average over the same two year period. Riordan's numbers were higher than the national average for the return on assets. This is a trend which the company should continue to strive for in order to stay competitive.

Collection PeriodFinally, when reviewing the collection period for Riordan and the industry average Riordan showed 1.9 days less time for collection in 2003 but increased the collection period for accounts receivable by 12 days in 2004 when compared to the industry median. This effect can have serious consequences on the company cash flow. The area of collections should be investigated in order to shorten the time frame for collections of receivables and provide the company with a better cash flow.

ReviewWhen considering...