IntroductionThe American specialist of risky mortgages, New Century Financial Corporation, has filed forbankruptcy and is now under protection of Chapter 11 of the Bankruptcy Court.

The second-largest provider of home loans to high-risk borrowers (subprime) in the US collapsedamid rising delinquencies and defaults: in recent years, when housing prices wererising, millions of people used such mortgages to buy homes they otherwise could not afford.

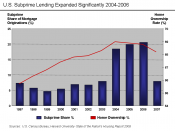

Once home prices leveled off, borrowers started to default on their mortgages. That wreakedhavoc on the subprime sector, which accounted for about a fifth of all new mortgages lastyear.

In addition to this sector crisis, the Californian company has cheated its lenders by makingdeliberate mistakes in its accounting. The company is under investigation by a number offederal authorities, including the Security and Exchange Commission, for its stock trading.

Like most subprime lenders, New Century sells its mortgages to investment banks that packagethese loans into bonds and trade them on the market.

In recent weeks, the value ofthose mortgages has plummeted as investors abandoned the sector. At Wall Street, thestock lost approximately 90% of its value.

Century is the centre of speculation about the fallout from the subprime market in part becauseit is one of the nation's largest subprime lenders, with an estimated $52 billion in subprimeloans last year.

More than one employee out of two will be laid off. New Century Financial Corp. has alreadysold its loan servicing units, and might sell some more, in order to audit a small part of itsdebts and repay the money invested by its lenders.

Some other financial actors (e.g. banks, hedge funds) or real-estate investors and companiesare already affected by this crisis (e.g. UBS, Barclays, ResMae Mortgage Corp.), andmany others might be in trouble soon too.

At a larger level, it is a whole economy that could...

Rise and Fall

A lot of work has obviously gone into this essay and it started well. However, there were many grammatical, as well as some spelling, errors which were very distracting and detracted from the overall essay.

0 out of 0 people found this comment useful.