Table of Contents

1.1 Introduction

1.2 NET PRESENT VALUE (NPV)

1.3 ADVANTAGES OF NPV

1.4 DISADVANTAGES OF NPV

1.5 PAYBACK

1.6 Arguments in favour of payback

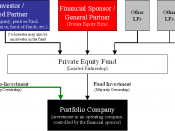

1.7 Debt vs Equity

1.8 Equity equals Ownership (Share Profits and Control)

1.9 Debt: Money You Owe

2.0 ADVANTAGES OF DEBT COMPARED TO EQUITY

2.1 DISADVANTAGES OF DEBT COMPARED TO EQUITY

2.2 Managerial Ownership and Agency Costs

2.3 Concentrated Ownership and Agency Costs

2.4 Debt and Agency Costs

2.5 PECKING ORDER THEORY OVERVIEW

2.6 CAPITAL MARKET TREATMENT OF NEW SECURITY ISSUES

2.7 HOW PECKING ORDER IS SUPERIOR TO THE TRADE-OFF MODEL

2.8 LIMITATIONS OF PECKING ORDER THEORY

2.9 Hedging

3.0 The Hedging Problem

3.1 Hedging Objectives

3.2 Risk Engineering

3.3 Controlling the risk

3.4 Profit after tax (PAIT)

3.5 Diversification

3.6 Beta

3.7 Advantages of Beta

3.8 Disadvantages of Beta

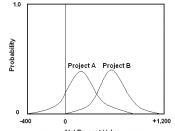

3.9 Re-Assessing Risk

4.0 Bonds and Debentures

4.1 Interest Rates.

4.2 Supply and Demand.

4.3 Preference Shareholders

4.4 Portfolio theory

4.5 Options

1.1Introduction

Characteristically, a decision to invest in a capital project involves a largely irreversible commitment of resources that is generally subject to a significant degree of risk. Such decisions have far-reaching effects on a company's profitability and flexibility over the long term, thus requiring that they be part of a carefully developed strategy that is based on reliable appraisal and forecasting procedures.

In order to handle these decisions, firms have to make an assessment of the size of the outflows and inflows of funds, the life span of the investment, the degree of risk attached and the cost of obtaining funds.

One of the most important steps in the capital budgeting cycle is working out if the benefits of investing large capital sums outweigh the costs of these investments. The range of methods that business organisations use can be categorised in one...