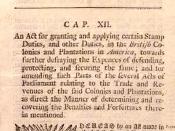

Though there were many reasons for the American Revolution, taxation was its starting point. The Sugar Act in 1764 and the Stamp Act in 1765 were both designed to increase British tax revenues so that Britain could pay off its debt from the French and Indian War and also to defend the colonies against native enemies to the west. Britain thought it only fair to have the colonies at least pay part of their protection. But when the Sugar act was passed it caused alarm in the American colonies, because of the expected economic disadvantage that would compound with the general post-war depression, in addition to having no representation in the British Parliament. In response the colonists prepared to boycott English products, and in essence threatened Parliament's authority. Revenue was still to low so in January 1765 the Stamp Act was passed by Parliament to raise money to support soldiers stationed in America.

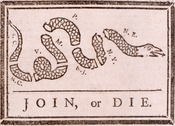

It called for a tax that colonists must buy stamps for deeds, mortgages, liquor licenses, law licenses and many other things necessary to run a business. Opposition to the act was strong and violent. Almost all assemblies in the colonies challenged the right of the British to tax them, and incidents occurred throughout the colonies as they prepared to boycott English goods again. After a year of protests, rioting, and debating, Parliament withdrew the Stamp Act, having underestimated the ability of the colonists. However parliament still didn't learn the lesson and in 1767, it passed the Townshend Act putting taxes on lead, paper, glass, paint, and tea passing through colonial ports. Around the same time the Writs of Assistance was also passed allowing customs officers to inspect cargo ships without a warrant. Colonists reacted by boycotting imported good and sometimes even tarred and feathered the customs officers. These taxes were also repealed in 1770. I believe that without the spur to action caused by the taxes, that the Americans would not have entered the war with as much energy and perseverance as they did. The taxes cause the colonists to organize and unite in opposition. The taxes also made it clear to the colonists that they were second class citizens, with no representation in the British Parliament further, the taxation cause them to realize how easily their property and freedom could be taken. Finally the unjust taxes helped the colonist to realize that the interests of the colonies and the crown were different and should be severed.

Sources http://www.stjohnsprep.org/htdocs/sjp_tec/projects/internet/sact.htm http://odur.let.rug.nl/~usa/E/sugar_stamp/actxx.htm http://www.plainedge.ourschools.org/teachers/murphyd/webdesig.n_/Murphy%20cases%20of%20the%20war.htm