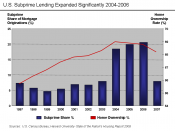

AbstractMost recently in the news, we have heard of ten financial institutions on the brinks of collapse, along with many other corporations across our country. (The Market Oracle, 08/22/08) The United States government has offered help to save a few of these faltering businesses, while most are turned away to make it on there on or possible seize to exist. Some of these institutions are now owned by the United States government or are now in debt to the government for millions of dollars. The Constitutional rights of such businesses will change and the protection of the legal rights of other businesses will change in the near future as it relates to the United States Constitution. Should the United States government place new restrictions on lending institutions?The most recent collapse of our financial institutions marks the first of such downfall since the 1920's. The United States government has come to the rescue of business like Fannie Mae and Freddie Mac who has more than 200 billion dollars in debt rollover problems.

While Lehman Brothers, which was founded in the 1850's filed bankruptcy on September 14, 2008. The type of government regulations on these business are plausibly the reason for their demise. The financial meltdown that hit Wall street and the global financial market was due to lack of regulations, that is a lack of regulation ON government.(L.K. Samuels, 11/29/08) The failure of the regulatory system were discussed in October 2008 on Capitol Hill. The sentiments of both democrats and republicans are to find out how it happened and to ensure that it never happens again. "The deregulatory philosophy that has prevailed during the last quarter has no grounding in economic theory or historical experience" said Joseph Stiglitz. "Quite the contrary, modern economic theory explains why the government must take an...