Financial Management- II

Case Notes

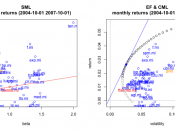

RPL and MRPL - Analyzing Risk and Return

Submitted By- Sumer Lal Meena

Exe-PGP 2007-09

�

Background Reading

The Capital Asset Pricing Model (CAPM)

Some, but not all, of the risk associated with a risky investment can be eliminated by diversification. The reason is that unsystematic risks, which are unique to individual assets, tend to wash out in a large portfolio, but systematic risks, which affect all of the assets in a portfolio to some extent, do not.

Because unsystematic risk can be freely eliminated by diversification, the systematic risk principle states that the reward for bearing risk depends only on the level of systematic risk. The level of systematic risk in a particular asset, relative to average, is given by the beta of that asset.

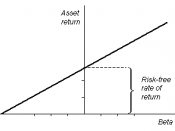

The reward-to-risk ratio for Asset i is the ratio of its risk premium, E(Ri) - Rf, to its beta, Bi: [E(Ri) - Rf]/Bi

In a well-functioning market, this ratio is the same for every asset.

As a result, when asset expected returns are plotted against asset betas, all assets plot on the same straight line, called the security market line (SML).

From the SML, the expected return on Asset i can be written: E(Ri) = Rf +Bi[E(Rm) - Rf]

This is the capital asset pricing model (CAPM). The expected return on a risky asset thus has three components. The first is the pure time value of money (Rf), the second is the market risk premium, [E(Rm) - Rf], and the third is the beta for that asset, Bi.

The CAPM implies that the risk premium on any individual asset or portfolio is the product of the risk premium of the market portfolio and the asset's beta.

The CAPM assumes investors are rational single-period planners who agree on a common...

Good case analysis

Its great job done by Mr. sl meena

0 out of 0 people found this comment useful.