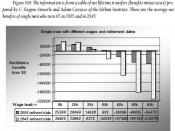

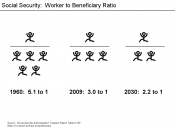

Social Security is a program for eligible workers and their dependants that provides income when they reach retirement age (65), become disabled or die. The US government's Social Security account is funded by taxes garnered from working men, women and their employers. The tax is 6.2 percent of a workers gross wages and the employers match that for a total of 12.4 percent. The money gains interest throughout the worker's life and in theory will be an additional source of retirement income. According to David John writing for The Heritage Foundation, Social Security benefits make up 90 percent of one third of all retirees income (par. 12). That percentage of income is not conducive to an additional source, that's conducive to a main source. One of the primary problems of Social Security is the future amount of benefits will soon exceed the amount of reserves. Right now a 25 year-olds Social Security tax is paying present retiree benefits; however by the time the 25 year-olds retire there won't be enough money coming in to pay their benefits.

The current workers are supporting the current retirees in a pay-as-you-go system. Soon there will not be enough workers to support each retiree. With out reform, Social Security will have to start borrowing money from other sources. These borrowed funds will only add to the current deficit and create more problems for future generations. The current system could be bankrupt as soon 2037.

The Social Security issue and its redesign has become a hot topic of debate for government leaders. There are several ideas on how to "fix" Social Security: raise taxes, decrease benefits, use general revenues or create private accounts. These suggestions require major changes to a program that many feel will only defer the problem rather than fix it.

Increasing the...