Topic: Spillover of the US Subprime Loan Crisis to Australia in Relation to the Banking Industry

What is the subprime loan crisis in the US? What were the causes of the crisis and how did it affect the US banking industry? How and why will the crisis spread to the banking industry of other countries? Did the crisis spill over to the banking industry in Australia? In what way and how? Provide evidence on this by examining the share prices of the US and Australian banking industries and how the share prices were impacted by the sub-prime crisis.

What is the U.S. sub-prime loan crisis?

To properly understand what the US sub-prime loan crisis is, it is necessary to understand what a sub-prime loan itself, actually is. Essentially a sub-prime loan, also known as a second chance loan or B loan, is one that is offered to borrowers with a low credit rating or a credit score generally below 620 (on a scale from 380 to 850).

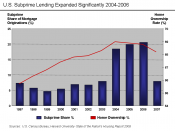

These loans are agreed upon with a higher interest rate as the risk for lenders is much greater than normal prime loans. This is due to the borrower's lower income, poor repayment history and overall probability of default. Often these loans are also made with no deposit, no verification of income and interest only payment plans, making them incredibly risky borrowers. Borrowers are happy to accept the higher interest rate in order to own their own home and assume that the price of their home will appreciate and they will gain equity in the market. As a result of this, home ownership in America has risen to 69%.

The difference between traditional loans and sub-prime loans is illustrated below:

Source: BBC News.com

Lenders originally took on these types of loans due to government...