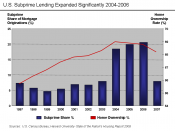

Where the crises started from?During the early part of the 21st century, when the housing boom and economic recovery in the United States encouraged a heavy spiralling in subprime mortgage lending. This increase saw a parallel increase in the securities offered through a pooling of such subprime mortgage loans through the process of "securitisation".

Investors moved from buying pooled mortgage loans to what is referred to as "non-agency transactions", ones where the willing investor undertakes the risk of the underlying mortgage loan. Such a transaction consisted of the issuance of securities out of a pool of mortgage loans without any backing of governmental funds. This contagion gripped the financial markets and manifested itself in a situation where investors jumped in significant numbers to take advantage of the booming housing market that prevailed in the early years of the new millennium (Foote & Willen, 2007).

Capital markets engaged in technological innovations for the riskier category of investors, which can be described like a "diverse maturity mortgage product," which led to pooling of mortgage loans with varied credit ratings into securities.

Many conditions conducive to subprime lending and securitisation of such loans induced investors to take the risk of investing in such loans. However, the expectations contained in these risks did not materialise. Fears grew of a threatening economic crisis that might result from delinquency for such loans not just in the United States but all over the world (Foote & Willen, 2007).

How and why it was started?The reasons for an increase in lending to such borrowers are varied. Firstly, favourable conditions existed for the residential housing market in the period between 2002 and 2005. Interest rates were low when compared to historical averages and home prices were appreciating in most markets. For example, the appreciation rate in the third quarter...

Thank God!!! Simple, Clear, Concise

I was stuck, looking for what the cause and effect of rising oil prices. BUT DIDNT KNOW IN BASIC EASY TO LEARN/READ TERMS How and Why of the crisis. Effects. Future Technological Implications.

VERY GOOD.

SIMPLE BUT PRECISE.

Thankyou !!!

1 out of 1 people found this comment useful.