Interest rates will continue to rise as the economy changes. In the state of Virginia there has been a clear shock of house shopping. In Virginia the immediate cities that surround Washington, DC it would be amazing if a single family house was found for under $500,000. Nevertheless, there are still townhouses that exist that are on the market for reasonable prices. Townhouses are often built on that same size and structure of a single family home. The question that has risen is what happened to the affordable housing market in these neighborhoods and will the pricing ever be the same again.

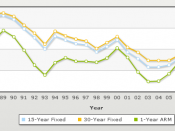

Sources say in 2000 the low interest rates made buying homes more affordable. Homeowners then say their house appreciate 5.6%, compared to the 1 to 3% increase during the 90's. Since then falling interest rates, job growth, and also the increase in population have resulted in the increased demand for purchasing homes.

This has set a breaking record home appreciation rate which was 21% in 2004. The rate of home appreciation has outpaced local incomes two or three times.

Home prices will continue to rise even at the current high interest rates. This is because of supply and demand. When demand for a product goes up so does its prices unless supply can increase to equal the demand. In Virginia there are more buyers wanting and some needing to buy homes but there are not enough homes available to buy. This is because of the lack of land to build on. According to December 2004 report by Fannie Mae Foundation the margin between Washington, DC and Virginia population growth has increased each year since the year 2000. The demand has risen because of the solid economy, and low unemployment. The supply of demand in Virginia is limited to...