Tangible and intangible assets are needs for all companies. These assets are financed with money borrowed from other entities, returns on money invested in such items as stocks and bonds, and in the form of other liabilities taken on by the company. Financial decisions require comparisons of cash payments at different dates. Understanding the Time Value of Money (TVM) is critical for a company to make sound purchasing and borrowing decisions.

Annuity investments provide a series of fixed payments that are paid at regular intervals over a designated time period. Annuities also earn interest that essentially helps the investment to deliver a constant amount of cash over a certain period. A perpetuity is an annuity that will have a "stream of level cash payments that never ends." (Brealey, Marcus, Myers, 2004).

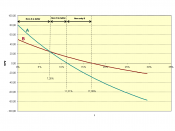

Interest rates and the compounding of interest have significant effects on investments and their growth. Simple interest is interest that is only earned on the initial investment.

Compounded interest is interest earned on interest. While simple interest will help an investment grow, compounded interest plays an even more significant role in the growth of an investment. Compound growth of interest means that investment value "increases each period by the factor (1 + growth rate). The value after t periods will equal the initial value times (1 + growth rate)t. When money is invested at compound interest, the growth rate is the interest rate." (Brealey, Marcus, Myers, 2004).

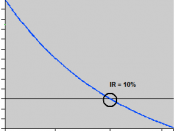

Present value and future value are used to measure the effect of time on the value of money. (Albrecht, Stice, Stice and Swain, 2005). Present value measures the value today of money that is either to be paid or received at a future time and at a designated interest rate. To determine the present value, the future value must be discounted by...