1. What is plotted on the yield curve? Be specific about the X and Y axes. Be specific about which securities' yields are plotted on a yield curve.

Answer:

U.S. Treasury Yield Curve

A yield curve that shows the relationship between yields and maturity dates for a set of similar bonds, usually Treasuries, at a given point in time. Yield curves are used to compare yields of different securities, to benchmark rates and to discover yield curve aberrations.

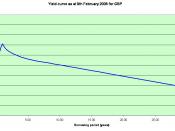

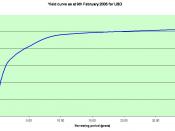

A yield curve is a chart that graphically depicts the yields of different maturity bonds of the same credit quality and type. Yield is depicted on the vertical axis and maturity on the horizontal axis.

X axes is term to maturity. For example, 30y means that the bond will mature in 30 years.

Y axes is yield rate. For example, 5yr bond's yield is equal 4.5%.

In the above graph, the 3 month, 6 month, 2 year, 3 year, 5 year, 10 year, and 30 year are plotted on yield curve.

For the case there are plotted the 1 month, 3 month, 6 month, 2 year, 5 year, 10 year, and 30 year bond yield.

2. Describe the terms: increasing, decreasing, flat and inverted curves. For each of the cases, describe the relation between short term rates and long term rates.

Answer:

Increasing yield curve:

Yield Curve: Description

scending Yield Curve This is the common shape in developed countries. It shows that yield rises for longer maturities.

Yield curves are usually upward sloping and accelerating.

The longer the maturity, the higher the yield. The usual explanation is that longer maturities entail greater risks for the investor and so require higher yields. In general the amount per year that can be made is dependent on the length of time that the money is...