Q1. Why do businesses keep accounting records? What are the objectives of financial reporting? If accounting is based on numbers, why are ethics so important for accountants?Acct. is the information system that measures business activity, processes the information into reports and communicates the results to decision makersAcct. is the language of business with which business decisions are madeManagers of businesses use accounting info to set goals for their orgs. Evaluate progress made towards achieving goals and take corrective action when it's neededFinancial reporting is used internally by owners + managers to make decisions, or employees to make collective bargaining agreements for compensation and promotionUsed externally by potential investors - determining viability of investing in a businessBanks (financial institutions) - decide whether to grant loansGovernment entities (tax authorities) - to know how much tax to chargeMedia and general public - general interest in a businessFinancial statements or financial reports are formal records of a business' financial activities; these statements provide an overview of a business' profitability and financial condition in both the short and long term.

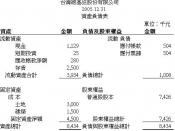

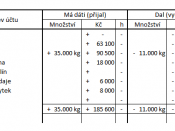

These statements include:The Balance sheet: a report on a company's assets, liabilities and net equity as of a given point in time. As at 30 April 20x7Income statement: report on a company's results of operations over a period of time, Revenue earned and expenses incurred. For month ended 30 April 20x7Cash flow statement: reports cash flow activities, operating (receipts revenue + payments suppliers/employees), investing (acquisition or sale of land) and financing (investment or drawings) Net increase/decrease in cash and cash balance between 2 periods for month ended April 20x7Statement of changes in equity: Investments + Net profit - Drawings. For the month ended April 20x7Ethics are important because it is easy to adjust numbers and create fraudulent financial statements to falsely satisfy investor expectations, meet...