Case 14: AMR - American Airlines | ||||||||||

Valuation: Valuing a Corporate Bond Issue | ||||||||||

AMR is the parent company of American Airlines. In addition to its primary subsidiary, AMR also operates several airline support companies such as the SABRE group (reservations), the Management Services Group, and American Eagle (a regional carrier). | ||||||||||

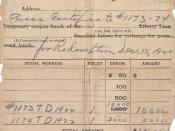

American Airlines is currently considering the issuance of a series of $1,000 par bonds. The coupon rate offered, based on current market interest rates and the Standard & Poor's based AMR bond rating, will be 10%. The current interest rate is coincidentally 10% as well. Interest on the bonds will be paid semi-annually. However, American cannot decide on the maturity of the new issue. The life of the bonds will be 10, 20, or 30 years. | ||||||||||

PREGUNTAS | ||||||||||

1 | Ignoring floatation costs, what will the bonds sell for today if American decides to issue the bonds with a maturity of 10 years? What will the price be if the bonds have a maturity of 20 years? 30 years? | |||||||||

Vencimiento de 10 años | Vencimiento de 20 años | Vencimiento de 30 años | ||||||||

Pago semestral | 50 | Pago semestral | 50 | Pago semestral | 50 | |||||

Tasa semestral | 5% | Tasa semestral | 5% | Tasa semestral | 5% | |||||

N | 20 | N | 40 | N | 60 | |||||

Valor a la par | 1000 | Valor a la par | 1000 | Valor a la par | 1000 | |||||

Precio Bono | -$1,000.00 | Precio Bono | -$1,000.00 | Precio Bono | -$1,000.00 | |||||

2 | If the bonds are issued with 10 years to maturity and the day after they are issued, the market interest rates increase to 12%, what will be the price of American Airline's bonds? What if interest rates drop to 8%? | |||||||||

Tasa de interés del 12% | Tasa de interés del 8% | |||||||||

Pago semestral | 50 | Pago semestral | 50 | |||||||

Tasa semestral | 6% | Tasa semestral | 4% | |||||||

N | 20 | N | 20 | |||||||

Valor a la par | 1000 | Valor a la par | 1000 | |||||||

Precio Bono | -$885.30 | Precio Bono | -$1,135.90 | |||||||

3 | If the bonds are issued with 20 years to maturity and the day after they are issued, the market interest rates increase to 12%, what will be the price of American Airline's bonds? What if interest rates drop to 8%? | |||||||||

Tasa de interés del 12% | Tasa de interés del 8% | |||||||||

Pago semestral | 50 | Pago semestral | 50 | |||||||

Tasa semestral | 6% | Tasa semestral | 4% | |||||||

N | 40 | N | 40 | |||||||

Valor a la par | 1000 | Valor a la par | 1000 | |||||||

Precio Bono | -$849.54 | Precio Bono | -$1,197.93 | |||||||

4 | If the bonds are issued with 30 years to maturity and the day after they are issued, the market interest rates increase to 12%, what will be the price of American Airline's bonds? What if interest rates drop to 8%? | |||||||||

Tasa de interés del 12% | Tasa de interés del 8% | |||||||||

Pago semestral | 50 | Pago semestral | 50 | |||||||

Tasa semestral | 6% | Tasa semestral | 4% | |||||||

N | 60 | N | 60 | |||||||

Valor a la par | 1000 | Valor a la par | 1000 | |||||||

Precio Bono | -$838.39 | Precio Bono | -$1,226.23 | |||||||

5 | Based on your answers to questions 2 through 4, what is the relationship between time to maturity and the price of the bond? | |||||||||

A medida que se incrementa los años de vencimiento del bono, también aumenta el precio del bono, ya que se incrementa el riesgo en el valor de la tasa de interés | ||||||||||

6 | Based on your answer to question 1, what is the relationship between current interest rates, the coupon rate, and time to maturity? | |||||||||

En este caso, estos factores no afectan el precio del bono ya que la tasa de interés del mercado es la misma que la del cupón del bono |

American Airlines

More Case Studies

essays:

C-SPAN, the American cable TV channel

... our government in action. In addition to video, C-SPAN also has 2 different audio networks that broadcast international and American political content, unfiltered and uncut. Also, C-SPAN has moved into the computer world and has established a homepage to ...

Large British Business Engineering company: British Petrolium

... Standard Oil outright, BP combined its existing interests in the US with Standard's operations to form a new company: BP America. The merging of Standard ... back its refining capacity, particularly in Europe, so that by the end ... are located in the United States, Spain, Australia and India. The company ...

On-line Recruiting - This paper was an assesment in which I was to asses an online recruitment service

Abstract The most significant change facing job seekers today is the introduction of on-line recruiting services. With the Internet becoming a way of life, it is natural that it would start making waves in the recruiting world. This paper addresses the advantages and disadvantages of online ...

Marketing Research- Starbucks vs. Coffee Beans

Market segmentation is defined as the process of dividing a market into distinct subsets of consumers with common needs or characteristics and selecting one or more segments to target with a distinct marketing mix (Schiffman, Bednall, Cowley, O'Cass, Watson and Kanuk, 2001). Different companies ...

Coca-Cola and its Evolution

... Coming. Roberto Goizueta said, 'Today, we have two messages to deliver to the American consumer, first, to those of you who are drinking Coca-Cola with its great ... Candler. Pemberton was forced to sell because he was in a state of poor health and was in debt. He had paid $76.96 for advertising, but ...