Peace, Order, and Good Government Is Not Cheap, Unless You Live in Alberta

An Analysis of Provincial Taxation

It would be quite a quite a fascinating project to skim through the pages of history, noting all the provincial politicians who have been awarded a term in public office, thanks mostly in part their promise of lower taxes. Doubly fascinating would be examining the legacy of said politicians, realizing that very few of them won their battle against the behemoth that is taxation, let alone the war. Whether it be naiveté, dishonesty or just plain stupidity, politicians in Canada seem to enjoy advocating the notion of lower taxes as a remedy for all their provinces' woes, however after attempting to act upon such promises, all that remains is yet another ringing endorsement for Will Rogers' theory that "The only difference between death and taxes is that death doesn't get worse every time Congress meets"1 (Substituting a more Canadian term in lieu of the word Congress).

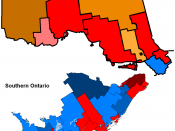

Between 1961 and 2003, the tax bill for the "average" Canadian family has increased by 1550%. In 1961 the "average" Canadian was making $5,000 and paying $1,675 (33.5% of their income) in taxes, forty two years later, the "average" Canadian was earning $58, 782 and paid taxes totaling $27,640 (47% of their income)2 . Even accounting for inflation, these figures show that the "average" Canadian is paying 13.5% more in taxes, then they would have forty two years ago. It is important to note that these figures merely present an accounting of the tax burden thrust upon the hypothetical "average" Canadian. Depending on which province a taxpayer lives in, the amount of ones income which is delegated towards the payment of taxes can vary by as much as 6.5%3 . To illustrate two extremes which showcase...