Introduction

In order to analyze and apply the C.A.P.M. on the stock of Toyota, one must know what the C.A.P.M. is. This is a formula which is actually an abbreviation of Capital Asset Pricing Model and is used in order to find the appropriate price of an asset. If we analyze the C.A.P.M., we can find the expected return of a stock, such as is demanded in this case. The C.A.P.M. consists of the risk-free rate, the beta of the stock (the risk factor of the stock) and the expected return of the market. The model has as follows:

After analyzing and solving this formula, one can get the expected return that we await from the company that is being analyzed in each situation. In this case, the expected return of Toyota is being analyzed.

Analysis

Starting from the risk free rate, we have the rate at which one can invest in an investment with no risk.

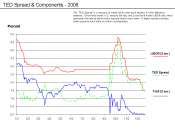

Of course, there is no actual investment which involves absolutely no risk, and that is why the risk free rate is only a theoretical rate used. In practice, the risk free rate is the rate given to short-term governmental bonds, or in the case of the U.S.A., the U.S. treasury bills are being used for the determination of the risk-free rate. These rates are called risk-free due to the fact that since they are governmental, there is very small possibility of default of the bill. So, as the risk-free rate, in this case, the rate of the U.S. treasury bills will be used, which is at 4,25%.

Moving on to the expected return of the market, this can be defined, as the average return that a market offers to an outside investor when entering the market. Due to insufficient data, the expected return...