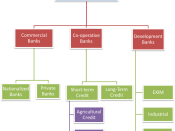

INDIAN BANKING SECTOR

WHAT IS BANKING?

Banking Regulation Act of India, 1949 defines Banking as óaccepting, for the purpose of lending or of investment of deposits of money from the public, repayable on demand or otherwise or withdraw able by cheque, draft order or otherwise.ô The Reserve Bank of India Act, 1934 and the Banking Regulation Act, 1949, govern the banking operations in India. The business activity of accepting and safeguarding money owned by other individuals and entities, and then lending out this money in order to earn a profit is known as banking. In general terms banking can be referred to the business conducted or services offered by the bank. The term bank derived from that Italian word "Banka" and the banking refers to the companies that provides banking products and services such as checking and saving, deposits, Loans, leases, Mortgages credit cards ATM network , securities brokerage investment banking, insurance , mutual funds and pensions (Kamath, 2005).

Banking means accepting for the purpose of landing or investment of deposits of money from the public repayable on demand or otherwise one withdraw able by cheque, draft or otherwise Banks in India were started on the British Pattern in the beginning of the 19th century. At the time of Second World War about 1500 joint stock banks were operating in undivided India, out of which over 1400 were non- scheduled banks. These banks were managed by bad and dishonest management and naturally there were number of bank failures. Hence the government has to step in and the banking companies act 1949 was enacted which led to gradual elimination of weak banks who were not in position of fulfill the various requirements of the Act. In order to strengthen the weak banks and receive public confidence in banking system , a...