What lies beneath the society we created? What binds all that we hold dear, if not economics? The first in control of the U.S federal system is The Federal Reserve Board. The chairman of the Federal Reserve Board is considered the second most powerful person in the world; second only the President of the United States. Though, so power the Fed (Federal Reserve Board) only has two functions: Monetary and Open Market policies. With these tools are their control, the Fed can save or destroy the American Economy by expanding and contracting the money supply.

Monetary policy is based the Fed's relationships with the private banks of the US. The 12 Federal Reserve banks are the banker's bank. They provide the money that fills the private banks the US in doing so they can also control what is done the money including how you spend or save your money.

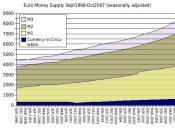

The first option the Fed has is the interest rates (also known as the discount rate) in which they lend the money to banks. With an increase of the interest rates the increase "price" of the money is passed on the people as increase in interest rates for personal loans. One might ask why the Government would condone such a thing? In dives into a simple concept of supply and demand; when there is a lot of something the value of it goes down, this is true for money also. If everyone spends their money, too much money will be available, thus the value of money goes down in which prices will go up, a process called inflation. Amazingly deflation occurs when there is not enough money available and the price drop and no one can get enough money to pay for goods. In conclusion when the Federal Reserve Board decides to increase the interest rates the amount of money that banks will consume will decrease and so will the money in circulation.

The reserve ratio has a dual purpose that we will dive into later. The reserve ratio is the percent of money taken in by banks that must stay in banks. An example is that if you put 100 dollars in a bank and the reserve ratio was at 10% the bank would be required to keep 10 of your dollars in the bank and would be allowed to loan out the rest. One would tend to ask, what does this mean? The bank owes you interest because you deposited your money into it, so it needs to make money to pay you bank and to make profit to expand the business, it does this mostly by loaning the money out for a higher amount of interest then the bank owes you and the Federal Reserve Board. The bank's first impulse is to loan out all money possible to make the most amount of profit because chances are that you won't want your 100 dollars all at once. If the bank does loan all of its money there might be a chance if you go they won't have the money you deposited, money that you need for bill, ECT. With the Reserve Ratio it guarantees at least some of your money being in the bank at any given time, there are also other safe nets in place to insure all of your money will be their at all times regardless of how much the bank loans out. In basics the reserve ratio also helps keep money out of circulation. In conclusion the reserve ratio is used to keep money in the banks for you and the economy.

After covering Monetary polices we will look at the Open Market aspects of the Federal Reserve. The Federal Reserve has the right to issue and buy bonds. Bonds are usually government issued documents that promise to pay the bearer a certain amount of money in a set amount of time. The Fed will issue bonds to contract the money supply because banks pay for the bonds (when the Fed issues bonds banks are always willing to buy because of how secure they are) and the money will go to the Fed who in turn just sits on the money. One might wonder that if the Fed will have to pay back the bonds with interest in time won't that mean the money supply will expand too much at that later date? It really comes down to how much the interest return the bonds are worth which is calculated by the average inflation rate over the period of time. What does that mean? Money loses its value over time (about 3% a year) and will that the Fed can calculate about how much the money supply will expand when the bonds get cashed in. Another reason the Fed will issue relatively high yield bonds is that the Fed usually doesn't care too much about tomorrow are they do today. The Fed will also buy bonds to increase the money supply. Bonds are some powerful stuff.

We have covered all the things the Federal Reserve Board will do to contract and expand the money supply but we can always keep asking the question why. The US needs to maintain a certain level of everything to keep stable. The United States need 3%-4% inflation and 3% growth in GDP (Gross Domestic Product), also needed is 3% unemployment rate (yes we need jobless people around!). All these things must be kept in check to keep everything going well.